Analysis of Trades and Trading Tips for the British Pound

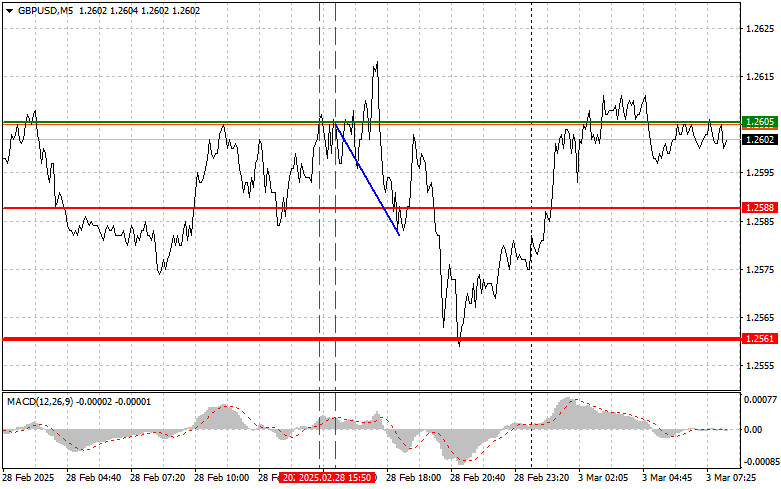

The first test of the 1.2605 price level occurred when the MACD indicator had already risen significantly above the zero mark, limiting the pair's upward potential. For this reason, I chose not to buy the pound. A second test of 1.2605 shortly afterward took place while the MACD was in the overbought zone, allowing Scenario #2 for selling to unfold, which resulted in a drop of more than 40 pips.

At the end of last week, news that the core personal consumption expenditures (PCE) index in the U.S. declined year-over-year did not strengthen the dollar, preserving the possibility of a bullish rebound in GBP/USD. This data indicated a slowdown in inflation growth, which is typically a positive signal for a currency. However, the market seemed to have already priced in this information, leading to a muted reaction.

Today, the UK Manufacturing PMI report is expected, and the forecast anticipates a moderate reading. This data will provide a clearer picture of the state of the British economy, especially considering the ongoing inflationary pressures. The Manufacturing PMI is a key indicator that reflects industry sentiment and offers insights into production trends and new orders. A reading above 50 points signifies growth, while a reading below indicates contraction.

Additionally, data on net consumer credit lending will be released today. This will show how actively households borrow, which can reflect consumer confidence or financial instability. Increased lending may stimulate economic growth but also raise debt burden risks. The number of approved mortgage applications serves as a barometer of the housing market. A rise in approvals usually signals strong demand for housing, potentially driving price increases, whereas a decline suggests a cooling market.

For intraday strategy, I will focus more on implementing Scenarios #1 and #2.

Buy Signal

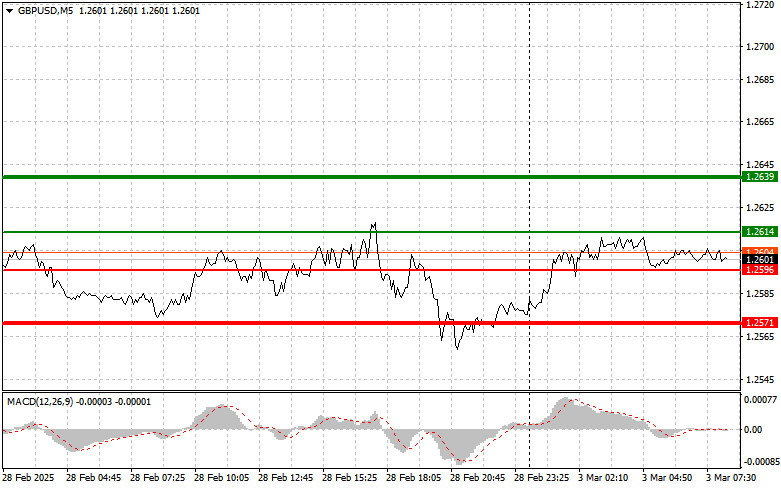

Scenario #1: I plan to buy the pound when the price reaches 1.2614 (green line on the chart), aiming for a rise to 1.2639 (thicker green line). At 1.2639, I plan to exit the long position and open a short trade in the opposite direction, expecting a 30-35-pip move back down. A pound rally is only likely as part of a corrective upward move. Important: Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: Another buying opportunity will arise if the price tests 1.2596 twice while MACD is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal, with expected growth toward 1.2614 and 1.2639.

Sell Signal

Scenario #1: I plan to sell the pound after the price breaks 1.2596 (red line on the chart), leading to a sharp decline in the pair. The key target for sellers will be 1.2571, where I plan to exit short positions and immediately open a long trade in the opposite direction, expecting a 20-25-pip bounce. It's best to sell the pound as high as possible. Important: Before selling, ensure the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: Another selling opportunity arises if the price tests 1.2614 twice while MACD is in the overbought area. This will limit the pair's upside potential and trigger a market reversal downward, with expected declines toward 1.2596 and 1.2571.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.