Wall Street Loses Ground

The new trading day on global markets began with notable losses. US index futures fell into the red, with the S&P 500 down 0.5% and the Nasdaq down 0.6%. Investors remain nervous about slowing US economic growth and escalating trade tensions around the world.

Asian Markets in the Red, Except Japan

Asian markets also reacted to the negative news. Hong Kong's Hang Seng and CSI index of major Chinese companies fell by 0.1%, while Taiwan's TWII lost 0.4%. At the same time, Japan's Nikkei managed to show a slight increase of 0.2%, balancing between minor losses and gains.

Safe assets are gaining strength

Amid instability, investors began to move into safe assets. The Japanese yen strengthened by 0.6%, reaching 147.245 per dollar, and the Swiss franc rose by 0.4%, reaching 0.8773 per dollar. Such dynamics indicate an increase in demand for safe currencies in the context of global economic uncertainty.

Deflation in China increases fears

New economic data from China only added fuel to the fire. In February, the country's consumer price index showed the sharpest decline in the past 13 months. At the same time, deflation of producer prices has continued for the 30th month in a row, which indicates weakness in the industrial sector.

In response to the alarming figures, Chinese authorities have promised to introduce additional measures to stimulate the economy. The focus is on supporting consumption and developing advanced technologies, including artificial intelligence. These statements were made against the backdrop of the start of sessions of the National People's Congress in Beijing, which will last until Tuesday.

Trump avoids predictions

On the other side of the world, US President Donald Trump chose to avoid making predictions about the impact of the tariffs he imposed on China, Canada and Mexico in an interview with Fox News. When asked whether they could trigger a recession in the US, Trump avoided a direct answer, leaving investors in further uncertainty.

As the economic situation continues to heat up, markets are still looking for signals that can indicate the direction of further movement.

Labor market has not met expectations

US economic statistics continue to disappoint investors. On Friday, new employment data was released, which showed that the labor market created fewer jobs than expected. The report is the first to fully reflect the impact of the Trump administration's economic policies, sparking a new wave of concern.

Experts: Trump's policies are shaking up the market

According to analysts, the current situation is largely due to the president's approach to managing the economy. Kyle Rodda, senior financial markets analyst at Capital.com, believes that Trump's actions are introducing an element of instability.

"Unlike his first term, when any slowdown in the economy or a decline in the stock market forced him to change course, he is now focused on long-term structural reforms, even if it comes at a short-term cost," Rodda said.

This strategic shift is causing concern among investors who are accustomed to a more flexible response to economic challenges.

US Treasuries are losing yield

The reaction of financial markets was not long in coming. Investors began actively buying up US Treasury bonds, which led to a decrease in their yields.

- The 10-year yield fell 6 basis points to 4.257%;

- The 2-year yield fell 4.5 basis points to 3.956%.

This trend reflects growing demand for less risky assets amid economic uncertainty.

The dollar weakened amid market volatility

The US dollar also lost ground in the currency market. The US dollar index, which tracks its performance against six major global currencies, fell 0.1% to 103.59 points.

The fall in the dollar and the decline in bond yields indicate continued investor concerns about the outlook for the US economy. Financial markets continue to monitor the situation, awaiting further signals from the Trump administration and the Federal Reserve.

Euro and Pound Strengthen Their Positions

Amidst the instability of the US dollar, European currencies demonstrated growth. The euro added 0.3%, reaching $1.0866, while the pound sterling strengthened by 0.2%, rising to $1.2946.

The growth of European currencies is partly due to the weakening of the dollar, caused by a decrease in the yield of US Treasury bonds. Investors prefer to hedge, moving into more stable assets, which supports the exchange rate of the euro and the pound.

Trump threatens Canada with new tariffs

The trade war continues to gain momentum. On Friday, US President Donald Trump made another tough statement towards Canada, hinting at the possible introduction of mutual tariffs on dairy products and lumber.

These threats have already begun to affect commodity markets, forcing investors to revise their forecasts for international trade.

Oil quotes under pressure

The oil market responded to new trade threats by lowering prices.

- Brent crude futures fell 0.4% to $70.11 a barrel;

- WTI lost a similar amount, falling to $66.76 a barrel.

Concerns about a global economic slowdown continue to weigh on oil prices, despite OPEC efforts to maintain price stability.

Gold remains a safe haven

The traditional safe haven asset, gold, showed a slight increase of 0.15%, reaching $2,915 an ounce. Investors continue to seek safe havens amid stock market turbulence and escalating trade conflicts.

Bitcoin collapses after disappointing executive order

The cryptocurrency market is under pressure again. Bitcoin lost 7.2% over the weekend, reaching this month's low of $80,085.42.

Earlier in January, the world's largest cryptocurrency hit an all-time high of $109,071.86, boosted by expectations of looser regulation under the Trump administration and the possible creation of a government cryptocurrency reserve. However, the executive order issued on Friday disappointed investors: the government does not plan to increase its purchases of bitcoin, which caused massive sell-offs.

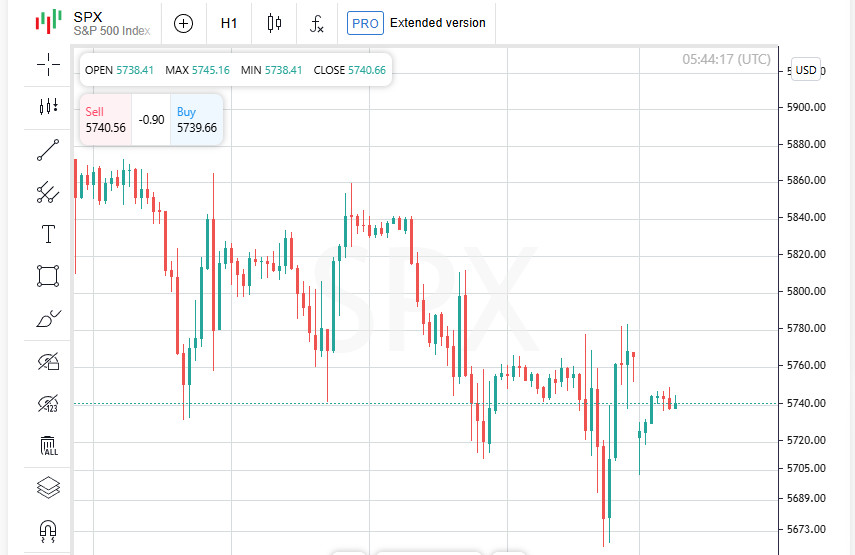

US stock market remains under pressure

Investors are anxiously awaiting the release of a key inflation report, which could be another blow to the stock market. Concerns about an economic slowdown and Trump's tough tariff policy have already led to significant losses.

Despite a small gain on Friday, the S&P 500 index ended its worst week in six months. The tech sector also suffered heavy losses, with the Nasdaq Composite falling more than 10% from December's record levels on Thursday, officially entering a correction phase.

Financial markets remain under pressure, with investors keeping a close eye on economic data to see what steps the US administration will take next.

Global Economic Turmoil

Financial markets continue to teeter on the brink of instability as they grapple with abrupt policy changes. US President Donald Trump has added to investor concerns by imposing new tariffs on imports from Mexico, Canada and China, adding fuel to trade tensions.

It is not just the US that is making markets nervous. Germany has unexpectedly announced a significant increase in government spending, triggering a sell-off in German government bonds (Bunds). The move points to possible fiscal changes that could impact the entire eurozone.

Fed Rates: Markets Hoping for Easing

Despite the worrying news, there is one silver lining on the horizon: weak US economic data has increased the chances of the Federal Reserve cutting interest rates further. Investors are counting on the Fed to try to ease a potential economic slowdown with a looser monetary policy.

However, these hopes may be short-lived. The US inflation report is due out on Wednesday, which could completely change the mood on the markets. If the data shows that price pressures remain high, it could force the Fed to keep tight monetary policy unchanged.

Inflation in Focus

The latest consumer price index (CPI) report for January has already caused concern. The 0.5% increase for the month was the largest jump since August 2023, which has increased doubts about the Fed's ability to quickly rein in inflation.

This time, experts are forecasting a 0.3% increase in the CPI in February, according to a survey of analysts. However, any deviations from this forecast could lead to volatility in stock markets and a change in rate expectations.

Fed Decision: Investors Watching Every Signal

This inflation report will be one of the last major economic data the Federal Reserve will review before its March 18-19 meeting. The regulator is currently expected to leave its benchmark rate at 4.25%-4.5%, but the market is closely watching the Fed's rhetoric.

Fed funds futures point to a rate cut of about 70 basis points by December 2025, according to LSEG. But if inflation remains elevated, the outlook could change, and rates could remain at current levels longer than investors expect.

Markets brace for high volatility

There is still much uncertainty ahead, and the coming weeks could be key for financial markets. Investors will be closely watching inflation data, central bank policies, and the Trump administration's next steps on international trade.

Any unexpected factor, from a tough statement from the Federal Reserve to a new wave of trade restrictions, could change the balance of power in the global market and determine the direction of asset movements in the coming months.

Stagflation: The worst-case scenario for the economy?

Investors are increasingly talking about the risk of stagflation, a situation where the economy slows while inflation continues to rise. This combination is considered a real nightmare for markets, as it reduces the purchasing power of the population and makes it difficult for companies to work, torn between rising costs and slowing demand.

Concerns are growing amid mixed data from the US labor market. On Friday, a new report showed an acceleration in job growth in February, but at the same time revealed the first signs of weakening in the previously stable labor market.

The main reasons are chaotic trade policy and cuts in government spending. Businesses are facing uncertainty, and workers are increasingly having difficulty finding stable vacancies.

Washington in Focus: Threat of a Shutdown

Additional concerns are raised by the situation in the US Congress, where heated debates over the new budget continue. If lawmakers fail to reach an agreement in the coming days, the country could face a partial shutdown of government agencies.

The prospect of a shutdown adds uncertainty: if government agencies stop working, this will exacerbate problems in the labor market, as well as slow down key government programs and business support.

Tariffs and Tariff Wars: Destruction or Strategic Maneuver?

US trade policy remains one of the main factors influencing global markets. The introduction of import tariffs can negatively affect corporate profits and lead to an increase in consumer prices, which further fuels inflation.

However, investors are unsure how long-term these measures will be. Many view them as a negotiating tool that can be canceled if trade agreements are reached.

Trump has already made temporary concessions: on Thursday, he announced that Mexico and Canada would get a tariff reprieve until April 2 if their goods fell under the terms of the previous trade agreement. However, the business community remains wary, fearing unexpected decisions from the White House.

New Trump Administration – New Level of Uncertainty

With Trump in his second term, the flow of new initiatives in the areas of trade, economics, and government cuts has increased significantly. This creates an effect of instability for American businesses, which are forced to constantly adapt to rapidly changing rules of the game.

Companies are unsure what other reforms may be launched in the coming months, which is holding back investment and development.

Stock markets are in panic: the VIX volatility index is rapidly rising

Amid general economic anxiety, investors are massively moving into safe assets, and the stock market is experiencing strong fluctuations.

The Cboe VIX, often called the "fear index," has surged this week to near its highest since late last year.

This suggests that market expectations are becoming increasingly jittery, with investors bracing for continued turbulence in the global economy.

Uncertainty is only growing

Financial markets remain tense, balancing expectations for more decisions from Washington, global trade instability, and rising inflation.

In the coming weeks, key factors determining the direction of markets will be:

- Congress' budget decision and the threat of a shutdown;

- Inflation data that could impact Fed policy;

- Trump's next moves on trade.

Any unexpected turn of events could trigger a new wave of market turmoil and force investors to rethink their strategies.