Analysis of Trades and Trading Tips for the Euro

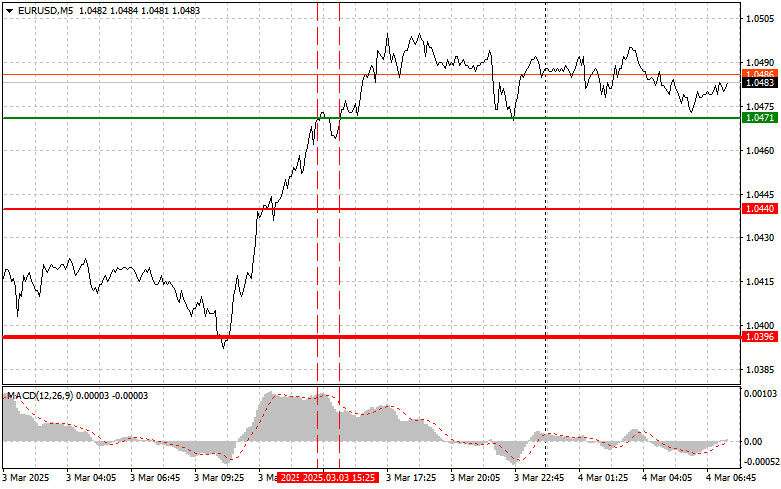

The first test of the 1.0471 level occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I chose not to buy the euro. During the second test of 1.0471, with the MACD in the overbought area, I was able to implement a second sell scenario. However, the price never declined, leading to losses.

Last month, manufacturing activity in the U.S. nearly stagnated due to declining orders and employment, while the price index for materials surged to its highest level since June 2022, amidst growing concerns about tariffs. According to data, the ISM Manufacturing Index fell by 0.6 points in February to 50.3, with readings above 50 indicating growth. Meanwhile, the price index rose by 7.5 points to 62.4. These figures reflect the challenging situation faced by U.S. manufacturers. On one hand, weak growth persists, but on the other, rising raw material costs are putting pressure on profitability. The increase in the price index could signal the onset of inflation, potentially forcing the Federal Reserve to reconsider its monetary policy. At the same time, declining orders and employment raise concerns about slowing economic growth. The potential impact of tariffs on supply chains and final prices is becoming an increasingly significant factor that must be taken into account.

Today, during the first half of the day, data on unemployment in Italy, changes in the number of unemployed in Spain, and the unemployment rate in the Eurozone will be released. The overall unemployment rate is expected to remain unchanged at 6.3%, which could potentially support demand for the euro. However, the European labor market is not uniform; differences in national economies, educational systems, and social support programs can offset the positive impact of a stable pan-European indicator. Only very strong data will help the euro maintain its upward momentum.

For intraday strategy, I will focus more on implementing Scenarios #1 and #2.

Buy Signal

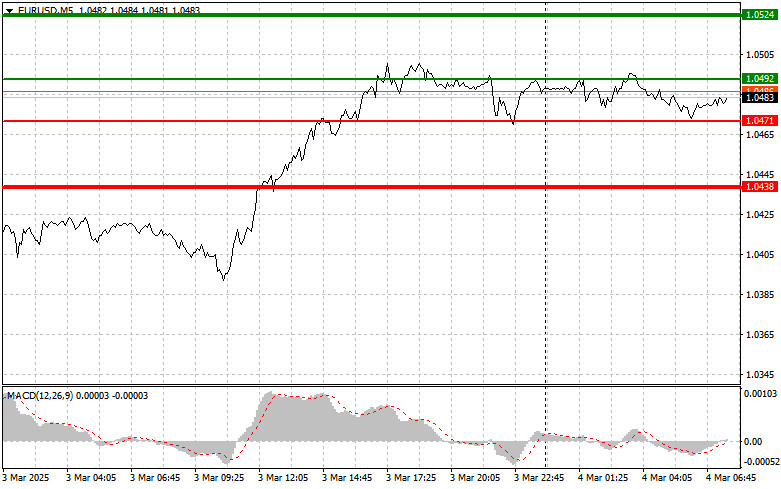

Scenario #1: Today, I plan to buy the euro if the price reaches around 1.0492 (green line on the chart), with a target of rising to 1.0524. At 1.0524, I plan to exit the market and sell the euro in the opposite direction, expecting a movement of 30-35 pips from the entry point. A rise in the euro in the first half of the day is only possible if the Italian and Spanish data are very strong. Important! Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the euro today if the price tests 1.0471 twice a row while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. Growth can be expected toward the opposite levels of 1.0492 and 1.0524.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches the 1.0471 level (red line on the chart). The target will be 1.0438, where I plan to exit the market and immediately buy in the opposite direction (expecting a movement of 20-25 pips in the opposite direction from the level). Pressure on the pair will return if today's data are very weak. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: I also plan to sell the euro today if the price tests 1.0492 twice in a row while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected toward the opposite levels of 1.0471 and 1.0438.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.