Analysis of Trades and Trading Tips for the Euro

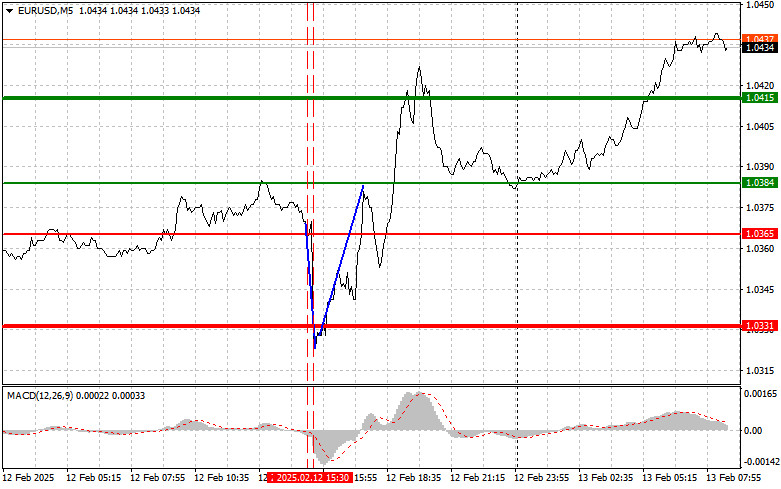

A test of the 1.0365 price level occurred when the MACD indicator had just begun to move downward from the zero mark, confirming a valid sell entry for the euro. As a result, the pair declined by approximately 30 pips. Meanwhile, buying on the rebound from 1.0331 allowed traders to capture about 40 pips in profit.

Clearly, euro sellers are facing significant challenges, as neither Powell's statements nor the news of rising inflation led to a stronger U.S. dollar. One possible reason for this could be a reassessment of risks following a phone conversation between the U.S. and Russian presidents. The resulting market volatility forced investors to reconsider their positions.

Regarding U.S. inflation, the initial reaction to the data suggested an increased likelihood of a more aggressive Federal Reserve policy, which traditionally supports the dollar. However, hints of potential improvements in U.S.-Russia relations, following the reported phone conversation, somewhat weakened this certainty. Speculation about possible geopolitical shifts can heavily influence financial markets. In this case, the prospect of reduced tensions between two major global players pushed investors toward riskier assets like the euro.

The bullish momentum may continue in the first half of the day today. Key economic indicators, including German inflation figures, will be released, along with the European Central Bank's economic bulletin and the economic forecast from the European Commission. The ECB's economic bulletin will be particularly important, as it could lead to adjustments in market sentiment. Investors will closely analyze the central bank's statements regarding inflation and economic growth prospects. Any hints of a more hawkish approach to monetary policy could strengthen the euro and weaken the overall bullish trend in the market.

The impact of Eurozone industrial production data is expected to be moderate. Small deviations from forecasts are unlikely to significantly alter the overall picture. More crucial will be the general assessment of the economy provided by the European Commission; a pessimistic forecast could apply downward pressure on the market, counteracting any morning positivity. While the German Consumer Price Index is important, its effects have largely been priced in by the market already. Additionally, as a national indicator rather than a pan-European one, its influence will likely be short-term and limited.

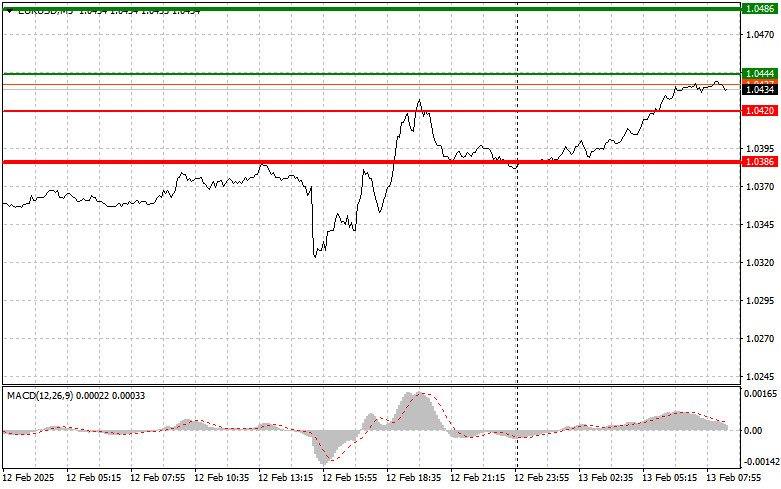

For my intraday strategy, I will focus primarily on scenarios #1 and #2.

Buy Signal

Scenario #1: I will consider buying the euro today if the price reaches 1.0444 (green line on the chart) with a target of 1.0486. At 1.0486, I plan to exit long positions and initiate short trades, expecting a 30-35 pip downward move. The bullish trend continuation can be expected in the first half of the day. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I will also consider buying the euro if the price tests 1.0420 twice while the MACD indicator is in oversold territory. This will limit the pair's downside potential and trigger an upward market reversal. The expected target levels are 1.0444 and 1.0486.

Sell Signal

Scenario #1: Selling the euro will be considered after reaching the 1.0420 level (red line on the chart). The target will be 1.0386, where I plan to exit shorts and immediately buy on a rebound (expecting a 20-25 pip upward move). Important! Before selling, ensure the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I will also consider selling the euro if the price tests 1.0444 twice while the MACD indicator is in overbought territory. This will cap the pair's upside potential and trigger a downward reversal. The expected downside targets are 1.0420 and 1.0386.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.