Analysis of Tuesday's Trades

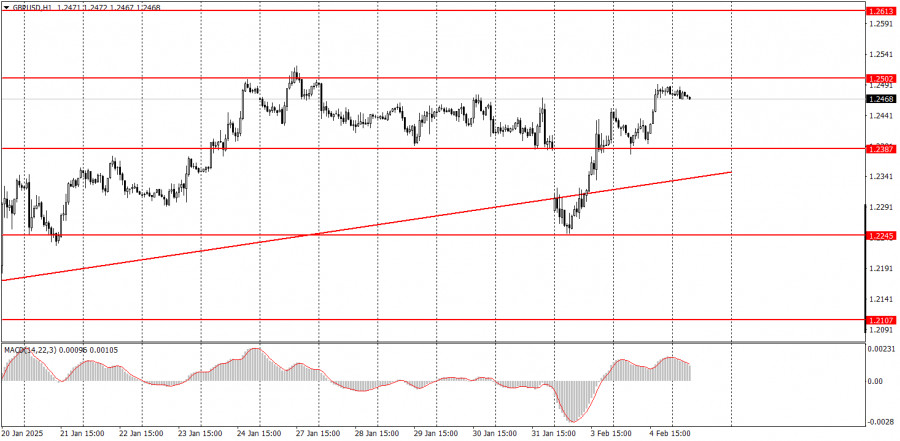

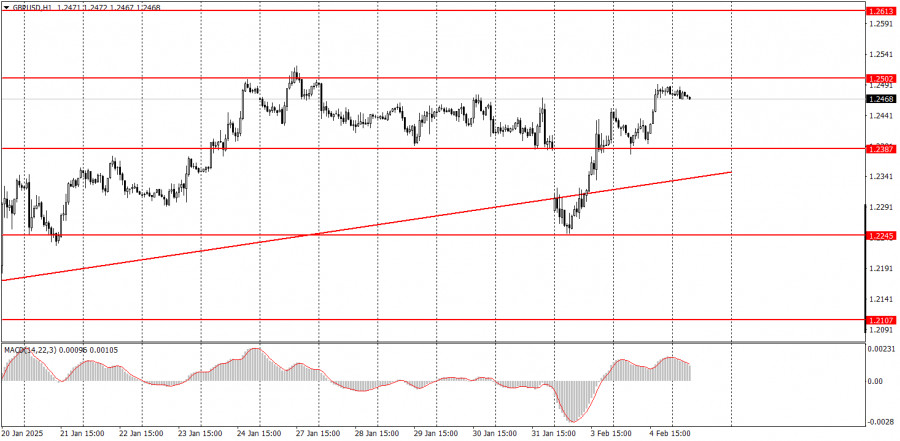

1H Chart of GBP/USD

On Tuesday, the GBP/USD pair continued its upward movement. In our previous articles, we cautioned that the trendline breakout might be false. Currently, the British pound has recovered to its local highs and seems poised to continue its bullish correction on the daily timeframe. However, it's important to note that this upward movement, which has persisted for nearly a month, is still a correction on the daily chart. As a result, on the hourly chart, the price action can appear quite complex, featuring constant pullbacks and alternating trends. Yesterday, there were reasons to buy the pair, particularly because the only significant report of the day—the JOLTs job openings in the U.S.—fell short of expectations. If other U.S. economic data disappoints as well, the dollar could weaken further. Nonetheless, keep in mind that this current growth is corrective. Additionally, the Bank of England's meeting is scheduled for Thursday, which could present new challenges for the British currency if their tone remains dovish.

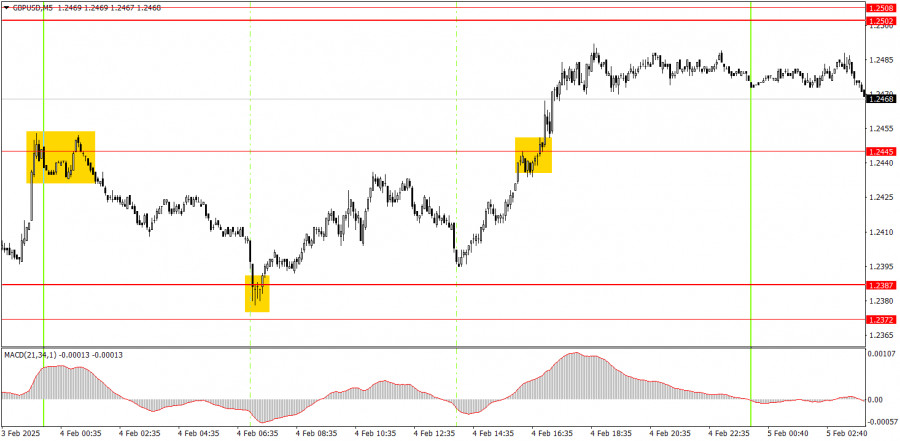

5M Chart of GBP/USD

On the 5-minute timeframe on Tuesday, an excellent buy signal appeared right at the start of the European trading session. This provided novice traders with a great opportunity to enter long positions at the lowest levels. Later, the price broke through the 1.2445 level, resulting in a total rise of 80 pips throughout the day, which could have been easily captured.

Trading Strategy for Wednesday:

On the hourly timeframe, the GBP/USD pair is currently forming a short-term uptrend, which we view as a correction. In the medium term, we fully anticipate a decline of the pound toward 1.1800, considering this the most logical outcome. Now, we just need to wait for the moment when the fall begins again. Movements this week may be volatile and challenging to interpret.

On Wednesday, the GBP/USD pair could initiate a downward pullback before potentially resuming its upward movement. As always, it is crucial to closely monitor key levels and macroeconomic events.

On the 5-minute timeframe, the following levels are relevant for trading: 1.2010, 1.2052, 1.2089–1.2107, 1.2164–1.2170, 1.2241–1.2270, 1.2301, 1.2372–1.2387, 1.2445, 1.2502–1.2508, 1.2547, 1.2633, 1.2680–1.2685, 1.2723, 1.2791–1.2798. On Wednesday, we will see the release of the services PMI indices in both the UK and the U.S., as both are significant indicators. Additionally, the U.S. will release the ADP report on changes in private sector employment, which will also attract attention. Thursday will bring the BoE meeting and a speech from Andrew Bailey.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.