The EUR/USD currency pair experienced a calmer trading session on Tuesday, although market participants still feel anxious. This anxiety stems from the swift decisions made by Trump, which caused a significant upheaval in global markets within just 24 hours. On Sunday morning, news emerged that Trump would impose tariffs on imports from China, Mexico, and Canada. However, by Monday evening, it was announced that Trump had already "frozen" the tariffs for Mexico and Canada after those countries reached agreements on drug trafficking and illegal immigration issues. The only remaining challenge, as was the case four years ago, is China.

As previously mentioned, Washington can exert considerable pressure on smaller countries such as Colombia and Panama. These nations often feel compelled to concede, as they risk losing much more by defying Trump's demands. It appears that Canada and Mexico also fall into this category of "weaker" nations, quickly scrambling to negotiate with the controversial U.S. president at the mere mention of tariffs. However, China has not backed down, and there are several reasons for this.

China stands as one of the strongest nations in the world, both economically and militarily. In short, China is unafraid of the U.S. The tariffs imposed by Trump, along with the reciprocal tariffs from Beijing, will result in losses for both sides. However, China refuses to be treated as a punching bag, as strong nations do not accept ultimatum-style negotiations. Consequently, China has become the first country during Trump's current term to engage in a trade war with America. So far, only in trade terms. Beijing swiftly imposed reciprocal tariffs on U.S. imports, including oil, agricultural products, coal, and gas.

With tariffs now imposed on both sides, officials from Beijing and Washington may consider sitting down at the negotiation table, but there's no assurance they will reach an agreement. As previously mentioned, China will not be treated as a punching bag. If Trump continues to issue ultimatums, Beijing is likely to respond with counter-ultimatums.

It's also important to note that many experts are currently confused about these sanctions and unsure of how to respond. For instance, if the dollar rose following the announcement of Trump's tariffs, what logic explains that? Is it yet another case of "anti-risk sentiment growth"? While sanctions against Canada and Mexico have been temporarily suspended, the only resolved issue has been unrelated to economics or trade. We believe Monday's market activity was merely an "emotional storm." The long-term impact of the tariffs on the U.S. economy remains uncertain, and it is unclear which tariffs will be upheld beyond 24 hours and enforced over a longer period. As such, there were no new fundamental reasons for the U.S. dollar to drop or rise on that day.

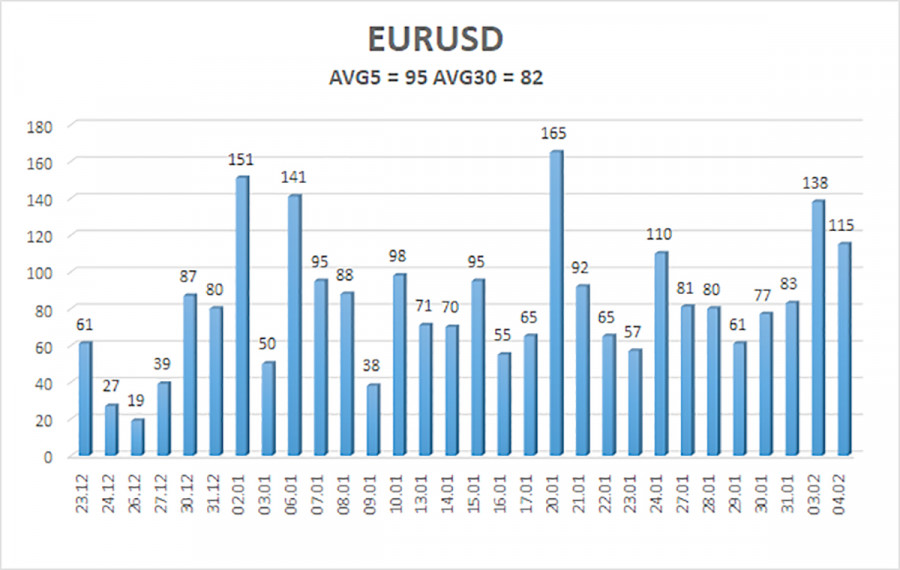

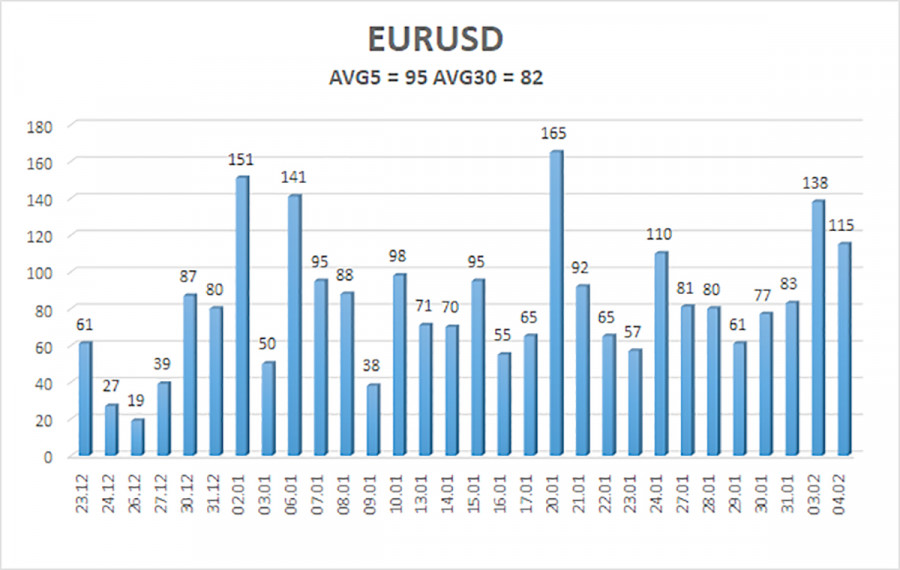

The average volatility of the EUR/USD currency pair over the past five trading days, as of February 5, is 95 pips, which is considered "average." We expect the pair to move between 1.0279 and 1.0469 on Wednesday. The higher linear regression channel remains downward, indicating that the global bearish trend is intact. The CCI indicator entered the oversold zone and has since started to climb back up from the bottom.

Nearest Support Levels:

- S1 – 1.0315

- S2 – 1.0254

- S3 – 1.0193

Nearest Resistance Levels:

- R1 – 1.0376

- R2 – 1.0437

- R3 – 1.0498

Trading Recommendations:

The EUR/USD pair has sharply resumed its downward trend and has quickly retraced upwards. For the past few months, we have consistently expressed our expectation of a decline in the euro in the medium term, and this view remains unchanged. The Federal Reserve has paused its monetary easing, while the European Central Bank (ECB) is increasing its easing measures. As a result, the U.S. dollar currently lacks any fundamental reasons to decline in the medium term, apart from potential technical corrections.

Short positions are still relevant, with targets set at 1.0200 and 1.0193, although the technical correction may persist for some time. If you're trading based on technical analysis, you might consider long positions if the price moves above the moving average, with targets at 1.0437 and 1.0469. However, it's important to note that any upward movement is still classified as a correction on the daily timeframe.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.