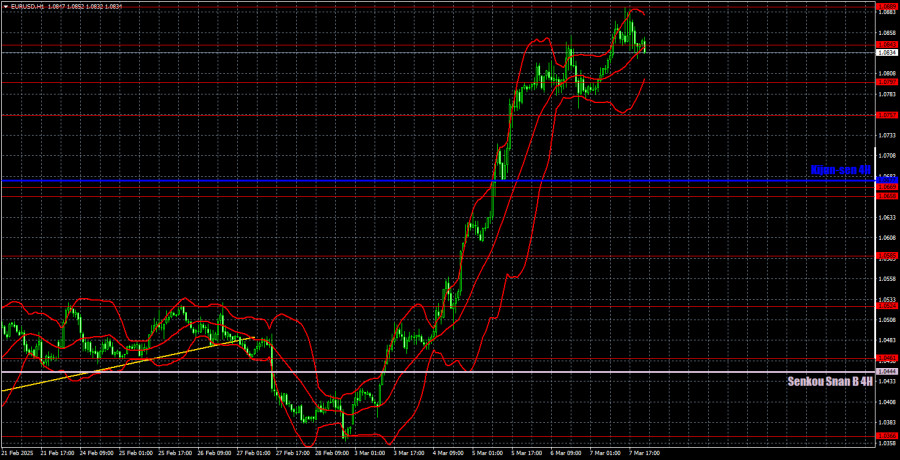

EUR/USD 5-Minute Analysis

On Friday, the EUR/USD currency pair saw a continued upward movement. However, in the latter half of the day, there was a slight decline that did not align with the macroeconomic backdrop. This dip was so minor that it remains unclear whether it was a reaction to Powell's speech—in which he reaffirmed his previous stance on monetary policy—or simply profit-taking at the end of the week. Unfortunately, the current market movement appears extremely unclear and illogical. The main concern is that last week, the market was primarily responding to a single factor: the new U.S. foreign policy. It is uncertain how long the market will continue to focus solely on this, disregarding other variables. What will happen once the market fully reacts to this factor? What additional news might come from Donald Trump, and how will the market respond to it? The level of uncertainty is at an all-time high.

As a result, we could witness any kind of market movement in the near future—predictions are difficult, as no one can anticipate Trump's statements tomorrow. Last week, the dollar was in a downward spiral, but this week, it could easily rise if Trump moderates his rhetoric.

There were several trading signals in the 5-minute timeframe on Friday, but the movements were chaotic. In principle, almost all signals were profitable; in each case, the nearest target level was reached. If traders followed each signal, they could have made very good profits. However, as mentioned earlier, the movements were sharp and chaotic. Additionally, important data were published during the U.S. session, adding to Friday's volatility.

COT Report

The latest Commitment of Traders (COT) report is dated March 4. The illustration above clearly shows that the net position of non-commercial traders has remained bullish for an extended period; however, bears have recently gained the upper hand. Four months ago, the number of open short positions held by professional traders sharply increased, causing the net position to turn negative for the first time in a long time. This indicates that the euro is now being sold more frequently than it is being bought. Nevertheless, the advantage of the bears is quickly diminishing following Trump taking office as the U.S. president.

Currently, we do not observe any fundamental factors that would support a strengthening of the euro. However, one significant factor has emerged that is contributing to the decline of the U.S. dollar. It is possible that the pair will continue to correct for several more weeks or months, but the 16-year downtrend is unlikely to reverse quickly.

At this point, the red and blue lines have crossed again, indicating that the market trend is now neutral. During the last reporting week, the number of long positions in the "non-commercial" group increased by 2,500, while the number of short positions decreased by 12,800. As a result, the net position increased by another 15,300 contracts.

EUR/USD 1-Hour Analysis

On the hourly timeframe, the price continues to soar into the stratosphere. A decline will likely resume in the medium term due to the divergence in monetary policy between the European Central Bank and the Federal Reserve. However, it remains unknown how long the market will continue to react to the "Donald Trump factor." The current movement is purely market panic, and it is unclear where it will lead the pair. Traders ignore everything except Donald Trump's statements, and the dollar is being sold at any price. The movement is almost vertical.

For March 10, we highlight the following trading levels: 1.0269, 1.0340-1.0366, 1.0461, 1.0524, 1.0585, 1.0658-1.0669, 1.0757, 1.0797, 1.0843, 1.0889, 1.0935, as well as the Senkou Span B (1.0444) and Kijun-sen (1.0677) lines. The Ichimoku indicator lines may shift throughout the day, so this should be considered when identifying trading signals. Don't forget to set a Stop Loss at breakeven if the price moves 15 pips in the right direction. This will protect against potential losses if a signal turns out to be false.

The most significant event on Monday will be the industrial production report from Germany. However, remember that the U.S. president is always active and ready to impose tariffs day and night. Such announcements can come unexpectedly, meaning the market reaction may be swift and unpredictable in advance.

Illustration Explanations:

- Support and Resistance Levels (thick red lines): Thick red lines indicate where movement may come to an end. Please note that these lines are not sources of trading signals.

- Kijun-sen and Senkou Span B Lines: Ichimoku indicator lines transferred from the 4-hour timeframe to the hourly timeframe. These are strong lines.

- Extreme Levels (thin red lines): Thin red lines where the price has previously bounced. These serve as sources of trading signals.

- Yellow Lines: Trendlines, trend channels, or any other technical patterns.

- Indicator 1 on COT Charts: Represents the net position size for each category of traders.