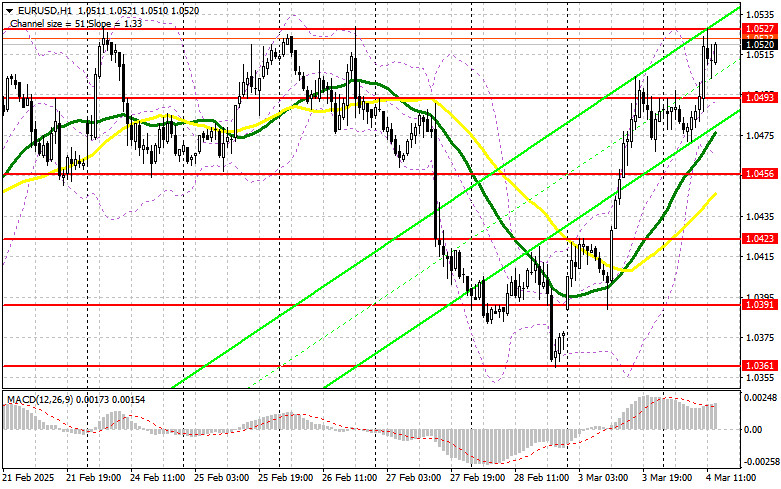

In my morning forecast, I highlighted the 1.0527 level and planned to make trading decisions based on it. Let's analyze the 5-minute chart to see what happened. The price increase followed by a false breakout at this level provided a short entry opportunity, resulting in a 25-point drop. The technical outlook has been revised for the second half of the day.

Opening Long Positions on EUR/USD:

Positive news about the decline in the Eurozone unemployment rate supported the euro in the first half of the day, leading to a rise in the EUR/USD pair. In the second half of the day, market participants will focus on the RCM/TIPP Economic Optimism Index in the U.S. and a speech by FOMC member John Williams. If Williams delivers a dovish message about interest rate cuts, it could further weaken the dollar against the euro.

I plan to buy only in the event of a decline toward the 1.0493 support level, which was established during the first half of the day. A false breakout at this level will provide a good entry point for buying with the expectation of continued growth toward the 1.0527 resistance, which was tested once during the European session. A breakout and retest from above will confirm a correct buy entry, targeting 1.0564. The final target will be 1.0593, where I plan to take profit.

If EUR/USD declines and there is no bullish reaction around 1.0493, demand for the euro could quickly decrease, leading the pair into a new sideways range. Sellers could then push the pair toward 1.0456, another key support level. Only after a false breakout at 1.0456 will I consider buying the euro. If the pair falls further, I plan to open long positions from 1.0423, expecting an intraday correction of 30-35 points.

Opening Short Positions on EUR/USD:

Sellers have not shown significant activity yet, instead focusing on defending the nearest resistance at 1.0527, which aligns with last month's high. A false breakout at this level, similar to the one discussed earlier, will provide an opportunity for short entries, aiming for a drop to the 1.0493 support level.

A breakout and firm consolidation below this range—which is only likely with very strong U.S. economic data—will offer another selling opportunity, targeting a decline to 1.0456, where the moving averages (MAs) currently favor buyers. The final target will be 1.0423, where I plan to take profit.

If EUR/USD rises in the second half of the day and bears fail to act around 1.0527, buyers could push the pair even higher. In that case, I will postpone short entries until the 1.0564 resistance test. I will sell only after an unsuccessful breakout attempt at this level. If there is no downward movement from 1.0564, I will look for short entries at 1.0593, aiming for a 30-35 point downward correction.

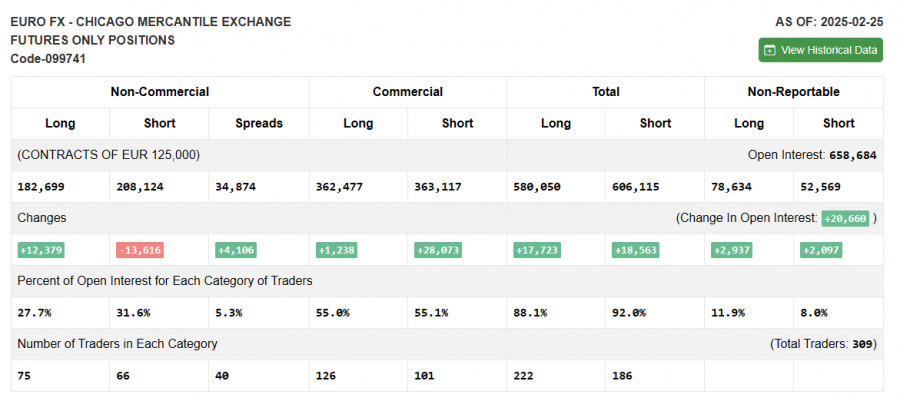

Commitment of Traders (COT) Report:

The COT report for February 25 showed an increase in long positions and a significant reduction in short positions, indicating growing interest in buying the euro. U.S. pressure on Ukraine to negotiate a halt to military actions continues to boost demand for risk assets. Additionally, inflation data from the Eurozone, which meets ECB expectations, supports further interest rate cuts, which should eventually benefit the economy and drive growth, making the euro an attractive asset in the current environment.

However, the overall balance still favors euro sellers, meaning buying at highs carries risks. The COT report indicates that long non-commercial positions increased by 12,379, reaching 182,699, while short non-commercial positions decreased by 13,616, falling to 208,124. As a result, the net difference between long and short positions increased by 4,106.

Indicator Signals

Moving Averages

Trading remains above the 30- and 50-period moving averages, indicating further euro appreciation.

Bollinger Bands

If the pair declines, 1.0456 will act as the lower boundary support of the Bollinger Bands indicator.

Indicator Descriptions:

- Moving Average (MA) – identifies the current trend by smoothing out market volatility and noise. Period – 50 (marked in yellow on the chart).

- Moving Average (MA) – identifies the current trend by smoothing out market volatility and noise. Period – 30 (marked in green on the chart).

- MACD (Moving Average Convergence/Divergence) – used to identify trend changes and momentum strength. Fast EMA – 12-period, Slow EMA – 26-period, Signal SMA – 9-period.

- Bollinger Bands – used to determine overbought and oversold conditions. Period – 20.

- Non-commercial traders – speculators such as individual traders, hedge funds, and large institutions, who use the futures market for speculative purposes and meet specific trading criteria.

- Long non-commercial positions – the total long positions held by non-commercial traders.

- Short non-commercial positions – the total short positions held by non-commercial traders.

- Net non-commercial position – the difference between short and long positions held by non-commercial traders.