Analysis of Trades and Trading Tips for the Japanese Yen

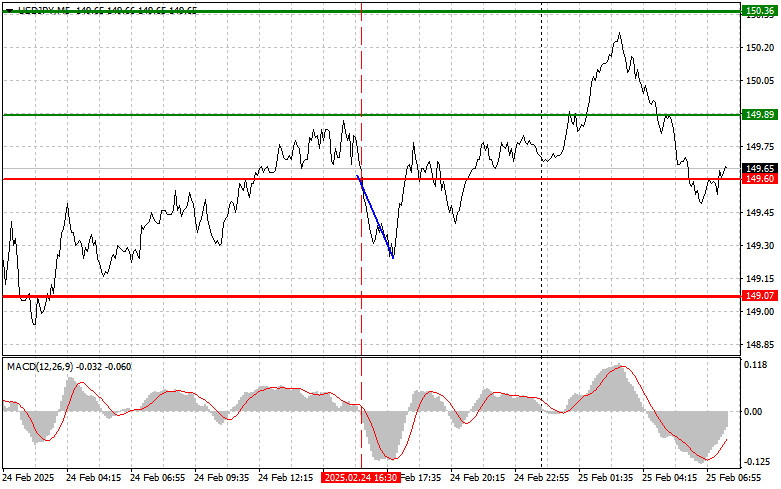

The test of the 149.60 price level occurred when the MACD indicator was beginning to move downward from the zero mark, confirming the correct entry point to sell the dollar. As a result, the pair dropped more than 30 pips but did not reach the target level of 149.07.

Today, demand for the yen has returned after the failed attempt by dollar buyers to hold above the 150 level. Japan's Corporate Goods Price Index (CGPI) data met economists' forecasts, showing growth. This indicator reflects the price dynamics of services exchanged between companies, published by the Bank of Japan. It plays an important role in monitoring the overall economic situation and forming monetary policy. The CGPI covers a wide range of services, from transportation and communication to financial and business services. A change in this index signals the rise or fall of operating costs for Japanese corporations, which may affect their profitability, investment decisions, and consumer prices. CGPI analysis requires considering many factors, including global economic trends, domestic demand and supply, and changes in regulatory frameworks. Growth in the index may indicate increasing inflationary pressure, prompting the BOJ to tighten its monetary policy, something many traders are counting on by buying the yen at any sign of its weakening against the USD.

I will focus mainly on executing Scenario #1 and Scenario #2 for the intraday strategy.

Buy Signal

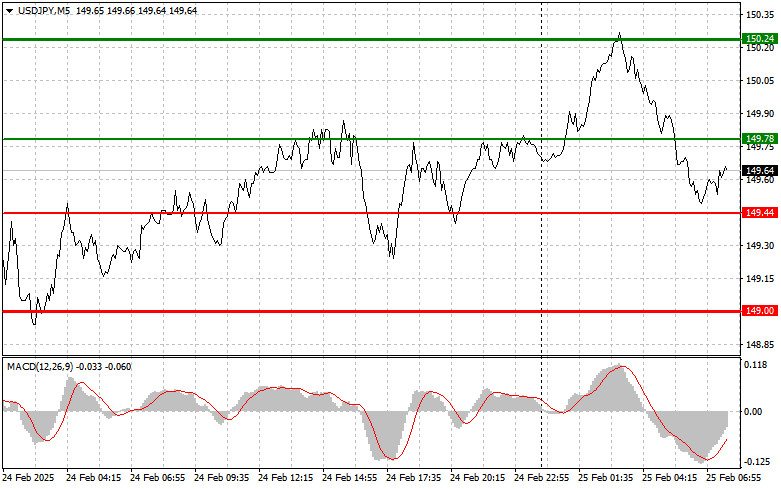

Scenario #1: I plan to buy USD/JPY today if the price reaches the entry point around 149.78 (green line on the chart), targeting a rise to 150.24 (thicker green line on the chart). At 150.24, I intend to exit the buy position and open a sell position in the opposite direction, aiming for a 30-35 pip movement back from this level. It's best to return to buying the pair during corrections and significant pullbacks in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy USD/JPY today if the price tests 149.44 twice consecutively while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward market reversal. Expected growth targets are 149.78 and 150.24.

Sell Signal

Scenario #1: I plan to sell USD/JPY today only after the 149.44 level is updated (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be 149.00, where I plan to exit the sell position and immediately open a buy position in the opposite direction, aiming for a 20-25 pip movement back from this level. Pressure on the pair can return at any moment. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting to decline.

Scenario #2: I also plan to sell USD/JPY today if the price tests 149.78 twice consecutively while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a downward market reversal. Expected decline targets are 149.44 and 149.00.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.