Bitcoin and Ethereum have plummeted amid growing concerns over US trade tariffs on China, Mexico, and Canada. Bitcoin has dropped from $100,000 to $91,000 in Asian trading, while Ethereum has decreased from $3,000 to $2,100 today.

Experts note that Donald Trump's actions—declaring a state of emergency and imposing tariffs on Canada, Mexico, and China—represent the most extensive act of protectionism by a U.S. president in nearly a century. These actions could have profound geopolitical and economic consequences, delivering a significant blow to the global competitiveness and economic power of the United States. Furthermore, protectionist policies are likely to provoke retaliatory measures from other nations. For instance, Canada and Mexico have already announced the possibility of imposing counter-tariffs on American goods. This escalation could lead to a full-scale trade war, resulting in devastating consequences for the economies of all affected countries.

Given this context, it is no surprise that risk assets, including cryptocurrencies and the U.S. stock market, have collapsed. Ethereum was hit the hardest, suffering a 26% loss at one point.

Robert Kiyosaki, the well-known author, believes that gold, silver, and Bitcoin (BTC) should be sold, predicting that these assets will decline even further in the near future. However, he also encourages people not to despair, suggesting that those who still have capital can take advantage of the situation by buying assets at their lows and becoming immensely wealthy.

Kiyosaki emphasized that periods of instability in financial markets present unique opportunities for investors willing to take risks and act decisively. He advocates for a proactive approach; instead of succumbing to panic and fear, investors should consider allocating funds to undervalued assets. In his view, every downturn presents not just a threat but also an opportunity to accumulate wealth. Kiyosaki also highlighted Bitcoin and other cryptocurrencies as potential key stores of value.

Moving forward, I will continue to base my actions on any significant pullbacks in Bitcoin and Ethereum, with the expectation that a bull market will resume in the medium term, which remains intact.

The strategy and conditions for short-term trading are described below.

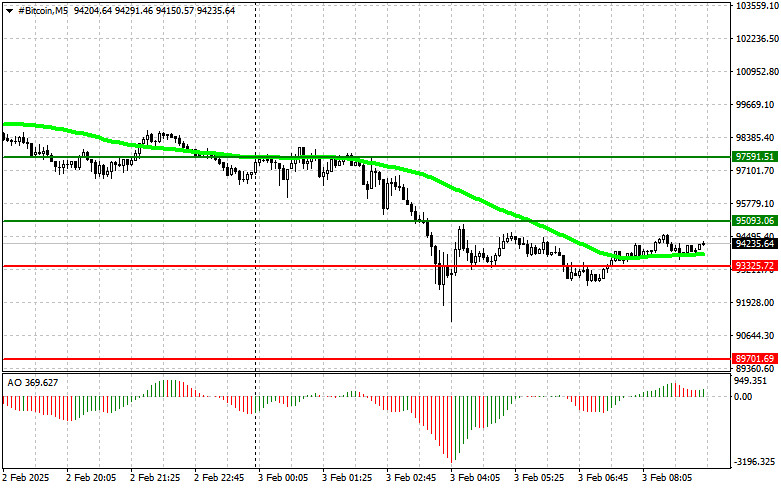

Bitcoin

Buy Scenario

Scenario #1: I will buy Bitcoin today upon reaching the entry point of around $95,000, with a target of rising to $97,500. Around $97,500, I plan to exit purchases and immediately sell on the rebound. Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Bitcoin can also be bought from the lower boundary of $93,300 if there is no market reaction to its breakout, with targets at $95,000 and $97,500.

Sell Scenario

Scenario #1: I will sell Bitcoin today upon reaching the entry point of around $93,300, with a target of dropping to $89,700. Around $89,700, I plan to exit sales and immediately buy on the rebound. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario #2: Bitcoin can also be sold from the upper boundary of $95,000 if there is no market reaction to its breakout, targeting $93,300 and $89,700.

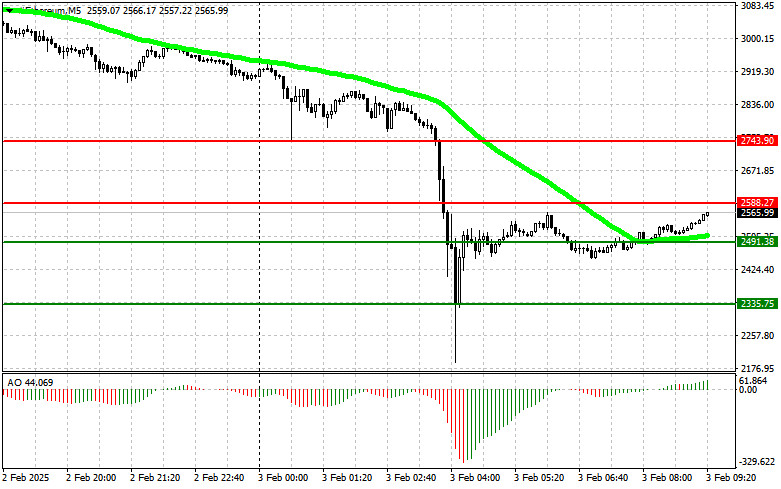

Ethereum

Buy Scenario

Scenario #1: I will buy Ethereum today upon reaching the entry point around $2,588, with a target of rising to $2,743. Around $2,743, I plan to exit purchases and immediately sell on the rebound. Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Ethereum can also be bought from the lower boundary of $2,491 if there is no market reaction to its breakout, with targets at $2,588 and $2,743.

Sell Scenario

Scenario #1: I will sell Ethereum today upon reaching the entry point around $2,491, with a target of dropping to $2,335. Around $2,335, I plan to exit sales and immediately buy on the rebound. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario #2: Ethereum can also be sold from the upper boundary of $2,588 if there is no market reaction to its breakout, targeting $2,491 and $2,335.