The GBP/USD currency pair has been on an upward trend for most of Wednesday, though at a slow pace. However, the market experienced a significant reaction following the release of the latest U.S. inflation report. As a result, the likelihood of even one interest rate cut by the Federal Reserve in 2025 has dropped to near zero, as U.S. inflation has risen for four consecutive months.

It's important to note that recent key macroeconomic reports from the U.S. have consistently indicated dollar strength and the resilience of the American economy. Even tariffs imposed during Donald Trump's presidency have been viewed positively by many market participants, who expect improvements in the U.S. trade balance and a reduction in the budget deficit. The only potential risk to the dollar stems from Trump's attempts to pressure the Fed into making aggressive rate cuts. However, Jerome Powell has stated multiple times that the U.S. president does not influence the Federal Reserve. Consequently, the current factors favor the dollar, while the only opposing force is the ongoing upward correction observed on the daily timeframe.

If it weren't for the need for periodic corrections, the British pound might have already approached $1.18, and the euro could have dipped below parity with the dollar. However, we maintain that the correction will continue. On the 24-hour timeframe, the price remains above the critical Kijun-sen line, which is expected to support the pair in the near term. While the correction is still relatively weak, it is understandable given that nearly all recent fundamental events and macroeconomic reports have been leading the market towards increased dollar purchases.

The Consumer Price Index (CPI) for January rose to 3.0% y/y, which was above forecasts. Core inflation also increased to 3.3% y/y, compared to the market's expectation of a decline to 3.1%. Thus, the U.S. dollar had no choice but to appreciate once again. However, what followed was the most interesting development for traders, especially beginners. Despite all factors indicating a resumption of the medium-term and global downtrend, the British pound resumed growth on Wednesday—still driven by the same correction.

If the dollar continues to decline systematically over the next two days, it will signal that the correction is likely to continue. However, during the remaining two days of the week, the pound may experience another setback. Today, the UK is expected to release its first estimate of Q4 GDP, along with the industrial production report for December. While these reports could potentially surpass forecasts, most recent UK economic data has been overwhelmingly negative. The final two trading days of the week may pose significant challenges for the pound, but such difficult situations often reveal the true sentiment of market participants.

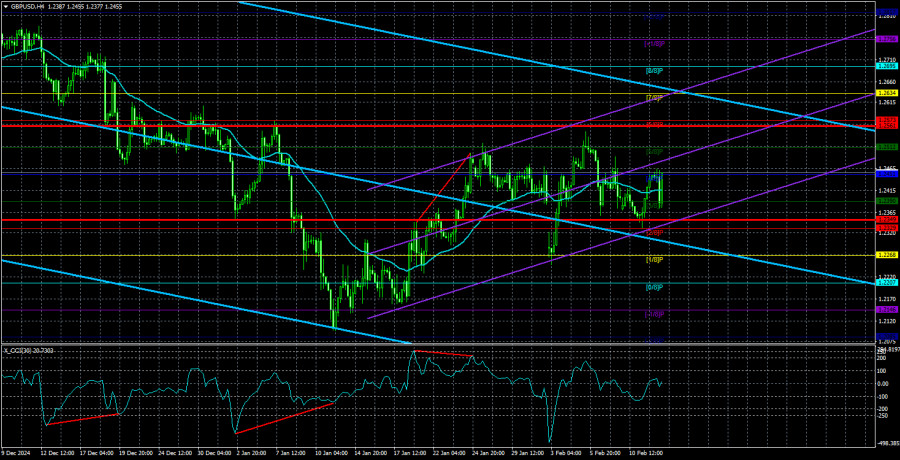

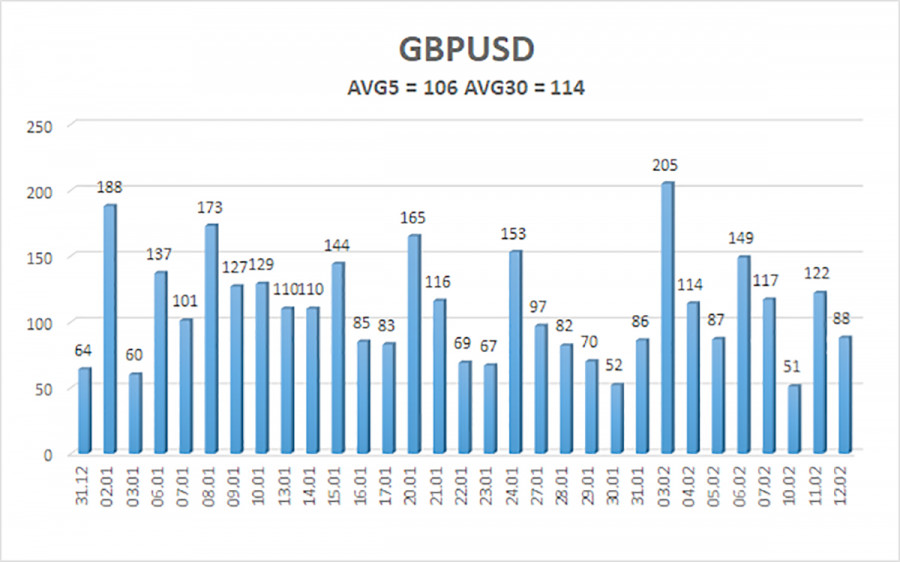

The average volatility of the GBP/USD pair over the last five trading days is 106 pips, considered "average" for the pound/dollar pair. Therefore, on Thursday, February 13, we expect the pair to trade within a range limited by the levels 1.2349 and 1.2561. The higher linear regression channel is directed downward, signaling a bearish trend. The CCI indicator previously entered the oversold zone, which served as a warning for a new upward correction.

Nearest Support Levels:

S1 – 1.2390

S2 – 1.2329

S3 – 1.2268

Nearest Resistance Levels:

R1 – 1.2451

R2 – 1.2512

R3 – 1.2573

Trading Recommendations:

The GBP/USD currency pair maintains a medium-term downtrend. Long positions are still not considered, as we believe that all bullish factors for the British currency have already been priced in multiple times, with no new drivers emerging. If you trade based on pure technicals, longs may be possible with targets at 1.2512 and 1.2573 if the price consolidates above the moving average line. However, sell orders remain more relevant, with initial targets at 1.2207 and 1.2146, as the upward correction on the daily timeframe will eventually end.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.