Trade Analysis and Trading Recommendations for the Euro

The first test of the 1.0372 level occurred when the MACD indicator had already moved significantly downward from the zero mark, which limited the pair's downward potential. For this reason, I did not sell the euro at that moment.

The second test of 1.0372, which occurred shortly after, aligned with the MACD being in the oversold zone, allowing Scenario #2 for buying the euro to play out. As a result, the pair rose by 20 points.

Only after the U.S. economic data release, another test of 1.0372 coincided with the MACD beginning to move downward from the zero mark, confirming a valid sell entry that resulted in a decline towards 1.0320.

Donald Trump's latest threats to impose tariffs on steel and aluminum from all countries triggered a new wave of euro weakness today. His repeated statements destabilize an already fragile global economy, which continues to face the consequences of geopolitical tensions.

High tariffs could trigger global trade wars, disrupt supply chains, and lead to higher inflation and slower economic growth. As a major economy heavily integrated into global trade, the euro is particularly vulnerable to such news. Risk-averse investors shift toward safe-haven assets like the U.S. dollar, putting additional pressure on the euro. Trump's unpredictable nature complicates forecasting which countries and industries will be affected the most.

Upcoming Events and Their Potential Impact

Today's calendar includes Eurozone Sentix Investor Confidence Index and ECB President Christine Lagarde's speech. The impact of these events on the market is likely to be moderate. The Sentix index serves as a useful sentiment gauge, but rarely causes sharp market movements. Markets focus more on key fundamentals, such as inflation and economic growth prospects.

Lagarde's speech is unlikely to bring surprises, as the ECB has been consistently supporting economic stability. However, if Lagarde hints at further stimulus measures, this could weaken the euro further.

Intraday Trading Strategy for EUR/USD

For today's trading, I will focus on Scenario #1 and Scenario #2.

Buy Scenarios

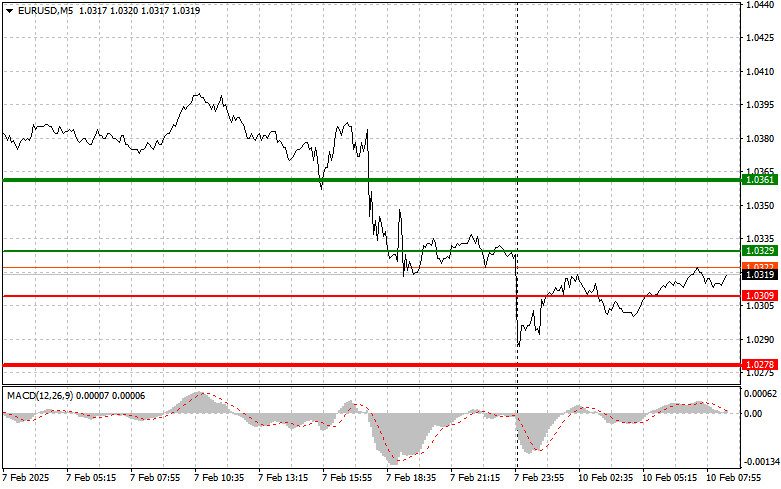

Scenario #1: Buy EUR/USD at 1.0318 (green line on the chart) with a target of 1.0358. At 1.0358, I plan to exit the market, as well as sell the euro in the opposite direction, counting on a movement of 30-35 points from the entry point. It is possible to count on the growth of the euro in the first half of the day after strong statistics. Important! Before buying, make sure that the MACD indicator is above the zero mark and is just starting to grow from it.

Scenario #2: Buy EUR/USD if there are two consecutive tests of 1.0278 while MACD is in the oversold zone. Target levels: 1.0318 and 1.0358.

Sell Scenarios

Scenario #1: Sell EUR/USD after reaching 1.0278 (red line on the chart). The target will be the 1.0247 level, where I'm going to exit the market and buy immediately in the opposite direction (counting on a movement of 20-25 points in the opposite direction from the level). The pressure on the pair will return in case of weak statistics. Important! Before selling, make sure that the MACD indicator is below the zero mark and is just beginning its decline from it.

Scenario #2: Sell EUR/USD if there are two consecutive tests of 1.0318 while MACD is in the overbought zone. Target levels: 1.0278 and 1.0247.

Chart Explanation

- Thin green line – Recommended buy entry point.

- Thick green line – Expected resistance level where profit-taking is advised.

- Thin red line – Recommended sell entry point.

- Thick red line – Expected support level where profit-taking is advised.

- MACD Indicator – Used to identify overbought and oversold conditions.

Important. Novice Forex traders need to make their entry decisions very carefully. Before the release of important fundamental reports, it is best to stay out of the market to avoid falling into sharp fluctuations in the exchange rate. If you decide to trade during the news release, always place stop orders to minimize losses. Without placing stop orders, you can lose your entire deposit very quickly, especially if you do not use money management, but trade in large volumes.

And remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Spontaneous trading decision-making based on the current market situation is an inherently losing strategy for an intraday trader.