Analysis of Trades and Trading Tips for the Euro

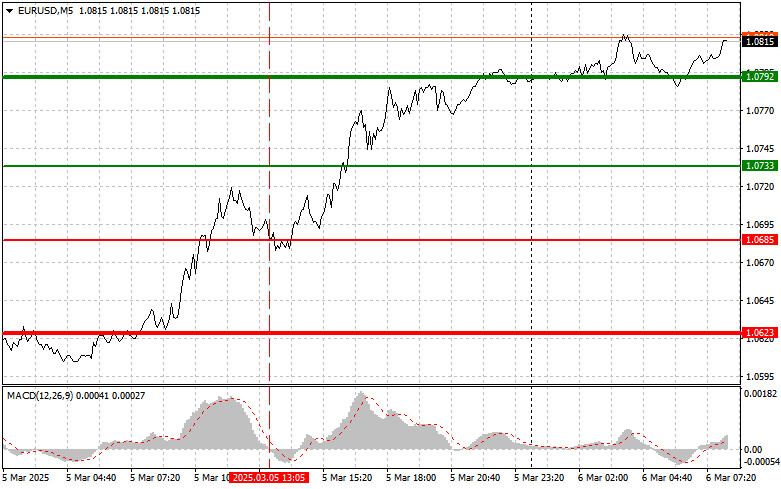

The test of the 1.0685 price level occurred when the MACD indicator was beginning to move downward from the zero mark, confirming the correct entry point for selling the euro. However, as seen on the chart, a proper correction never materialized, and the euro continued to rise, resulting in losses.

Despite strong data from the US services sector activity, the US dollar remained pressured against the euro. This indicates that the dollar's position is currently weak and that discussions about rate cuts in the US are not without reason.

The European currency, on the other hand, is showing resilience. It is supported by expectations of continued accommodative monetary policy from the European Central Bank and new fiscal measures from the German government, which will likely be followed by other countries.

A significant event is scheduled for today in the first half of the day—the ECB meeting. Most experts believe the central bank will lower interest rates, which has already been factored into the market. Therefore, the reaction to the monetary policy report and Christine Lagarde's press conference is unpredictable. Besides the rate decision, attention will be focused on the ECB's updated economic forecasts. Investors and analysts will soon closely examine the central bank's expectations for inflation and economic growth in the eurozone. Hints of worsening forecasts could increase expectations for further policy easing.

Equally important is how Christine Lagarde will present the decision and forecasts during the press conference. Her tone and rhetoric will influence market sentiment as investors seek signals about the ECB's future policy.

Overall, the ECB meeting will be eventful and impact financial markets, but geopolitical factors should also be considered, as they could add to the uncertainty.

For intraday strategy, I will focus more on executing Scenarios #1 and #2.

Buy Signal

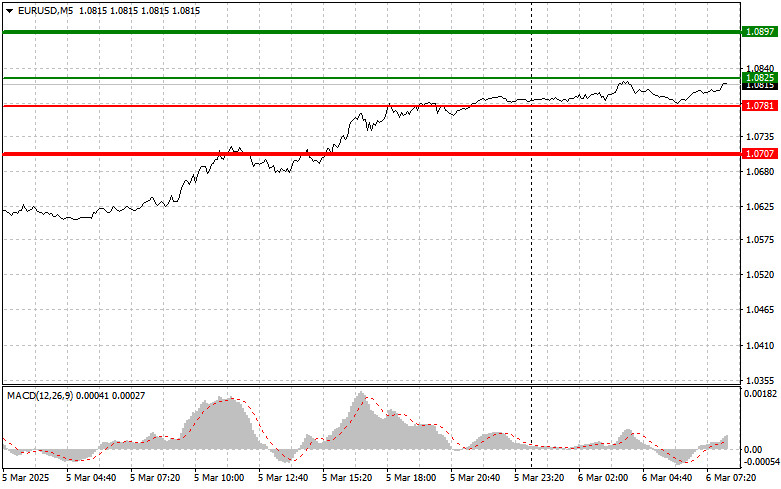

Scenario #1: Buying the euro today is possible at the 1.0825 level (green line on the chart), with a target of rising to 1.0897. At 1.0897, I plan to exit the market and sell the euro in the opposite direction, expecting a movement of 30-35 pips from the entry point. Euro growth in the first half of the day can be expected only after strong economic data from the eurozone. Important! Before buying, ensure that the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: Another buying opportunity arises if the price tests the 1.0781 level twice in succession while the MACD indicator is in the oversold area. This would limit the pair's downside potential and lead to a market reversal upwards. A rise to the opposite levels of 1.0825 and 1.0897 can be expected.

Sell Signal

Scenario #1: Selling the euro is planned after reaching the 1.0781 level (red line on the chart), targeting 1.0707, where I intend to exit the market and immediately buy in the opposite direction, expecting a movement of 20-25 pips in the other direction. Pressure on the pair will return if the ECB makes very poor decisions. Important! Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: Another selling opportunity arises if the price tests the 1.0825 level twice in succession while the MACD indicator is in the overbought area. This would limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 1.0781 and 1.0707 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.