Analysis of Trades and Trading Tips for the Euro

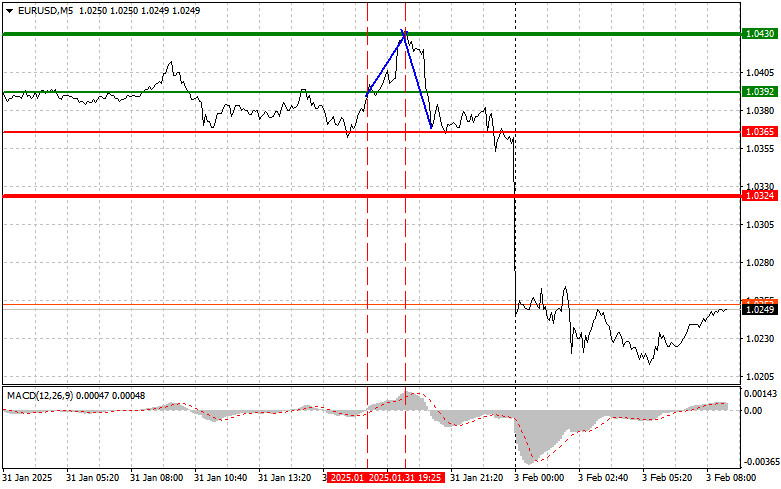

The test of the 1.0392 price level coincided with the MACD indicator beginning to rise from the zero mark, confirming it as the right entry point for buying the euro. As a result, the pair increased towards the target level of 1.0430. Selling from 1.0430 on the rebound, as I mentioned in my forecast for the second half of the day, allowed for an additional profit of 50 pips.

The introduction of trade tariffs has created tension in international markets, causing the euro to lose ground against the dollar. Investors are panicking and liquidating risk assets, which heightens market anxiety. Countries that are partners with the U.S., such as Canada and Mexico, have already announced plans to retaliate against the new tariffs, potentially escalating the trade war. These policies may negatively impact not only U.S. foreign trade but also its domestic market. Rising prices on imported goods could trigger inflation and reduce consumer purchasing power. While Trump claims that these measures are necessary to protect American manufacturers, many doubt their effectiveness.

Moreover, the consequences could affect other economies around the world, as the implemented measures might alter global supply chains.

Today, special attention will be given to the release of the Manufacturing PMI data for Eurozone countries. This indicator is an important barometer for assessing the state's economy, as it reflects activity in the manufacturing sector. An increase in the index could signal growth in manufacturing orders and, consequently, positive prospects for the region's economy.

Data on the Eurozone Consumer Price Index (CPI) is also anticipated. This metric directly influences the European Central Bank's monetary policy. Rising prices may compel central banks to reassess their approach to interest rates, which will, in turn, affect investments and economic dynamics. The core CPI will also be closely monitored, as it excludes volatile components such as food and energy. Effective control of inflation remains one of the key tasks for economists and policymakers, especially amid global market instability.

For the intraday strategy, I will focus primarily on the implementation of scenarios #1 and #2.

Buy Signal

Scenario #1: Today, buying the euro is possible upon reaching the 1.0267 level (green line on the chart) with a target of rising to 1.0317. At 1.0317, I plan to exit the market and sell the euro in the opposite direction, aiming for a 30-35 pip movement from the entry point. Counting on euro growth in the first half of the day is unlikely. Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the euro today in the case of two consecutive tests of the 1.0234 price level when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upwards. Expect growth towards the opposite levels of 1.0267 and 1.0317.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.0234 level (red line on the chart). The target will be 1.0184, where I plan to exit the market and immediately buy in the opposite direction (aiming for a 20-25 pip movement in the opposite direction from the level). Pressure on the pair could return at any moment. Important! Before selling, make sure the MACD indicator is below the zero mark and starting to decline from it.

Scenario #2: I also plan to sell the euro today in the case of two consecutive tests of the 1.0267 price level when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a downward market reversal. Expect a decline towards the opposite levels of 1.0234 and 1.0184.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.