The GBP/USD currency pair demonstrated remarkable resilience on Friday and throughout the past week. It's important to remember that throughout last year, we consistently pointed out that the pound was overpriced and clearly overbought. In September, the long-anticipated decline of the British currency began immediately following the first monetary policy easing by the Federal Reserve—something we had warned about in advance. Currently, while the pound is experiencing a rapid decline, it occasionally shows more resilience than the euro.

It's worth noting that last week, the pound faced fewer factors contributing to its decline compared to the euro. The Eurozone released a significant amount of macroeconomic data, all indicating downward trends, while no reports came out of the UK. However, even if the pound sterling isn't declining rapidly at the moment, this trend is unlikely to last long. This week, the Bank of England is expected to hold a meeting where a reduction in the key interest rate is anticipated with certainty. Although no other significant events are scheduled in the UK, inflation and GDP reports will eventually be released. Do we expect strong growth from the British economy?

Some traders and analysts may argue that inflation reports could support the pound. Indeed, inflation in the UK is on the rise again, but let's examine how it is increasing. The lowest point in recent years was in September, when inflation reached 1.7%. This was followed by an increase to 2.3% and then to 2.6%, before a slight decline to 2.5%. Currently, inflation in the UK is lower than that in the US. Given this scenario, which central bank should be cutting rates more aggressively?

We also believe that, for the Bank of England, economic performance currently takes precedence over inflation. Like the Eurozone, the UK's GDP has shown dismal figures since the second quarter of 2022. Only one quarter during this period recorded relatively strong growth—0.7%—while all other quarters were near zero, with some even negative. Therefore, the Bank of England needs to prioritize economic growth rather than solely focusing on inflation. Living with a 2.5% inflation rate is manageable, but coping with a stagnating economy is far more challenging.

Thus, our forecast remains unchanged. Both the euro and the pound may continue to undergo corrections for several more weeks or even months. On the daily timeframe, the current upward correction appears very weak. Since corrections typically last longer than trend phases, we wouldn't be surprised if the next leg of the downtrend begins around April, with the pound experiencing unjustified and illogical gains along the way. Overall, the British currency seems to have only one direction—downward. Additionally, if Trump continues on his current path, the dollar could face its own challenges. From our perspective, his sanctions against numerous countries are ultimately detrimental to the US economy.

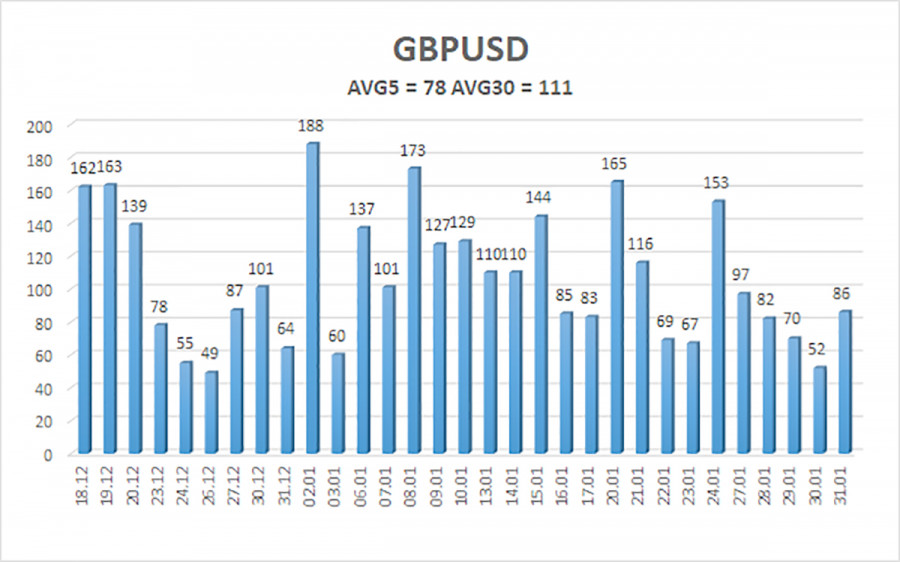

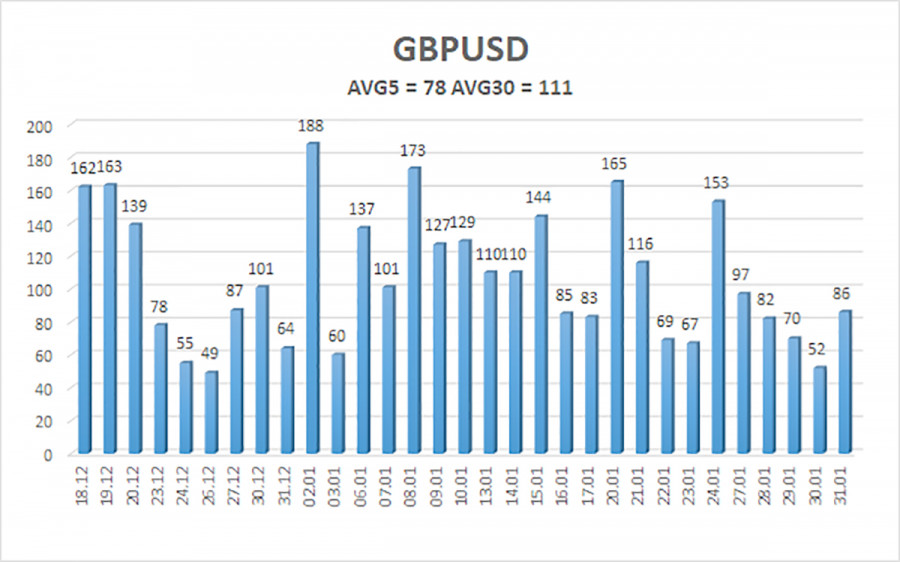

The average volatility of the GBP/USD pair over the last five trading days is 78 pips. For the pound/dollar pair, this value is considered "average." Therefore, on Monday, February 3, we expect movement within the range bounded by the levels of 1.2311 and 1.2467. The higher linear regression channel is directed downward, signaling a bearish trend. The CCI indicator entered the overbought zone and formed a bearish divergence. A new downward movement is expected.

Nearest Support Levels:

S1 – 1.2390

S2 – 1.2329

S3 – 1.2268

Nearest Resistance Levels:

R1 – 1.2451

R2 – 1.2512

R3 – 1.2573

Trading Recommendations:

The GBP/USD currency pair is currently displaying a bearish trend in the medium term. We do not recommend taking long positions, as we believe that all potential growth factors for the British currency have already been fully priced in by the market, and there are no new developments to support further increases. For those who trade based solely on technical analysis, long positions may be viable if the price remains above the moving average line, with target levels set at 1.2512 and 1.2573. However, sell orders are more relevant at this time, with initial targets at 1.2329 and 1.2311.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.