The EUR/USD currency pair continued to trade higher on Wednesday, once again failing to settle below the moving average line. Donald Trump keeps announcing new tariffs — or previously announced ones go into effect — or trade partners respond with their own tariffs. Every day, we're witnessing more of the same: the dollar falls, stock markets sink, and demand for safe-haven assets rises, clearly reflecting the current market sentiment.

In this article, we'd like to discuss how quickly one can lose the throne. The U.S. economy has long been and remains the largest in the world — and likely will be for quite some time. But the climb to dominance was long and arduous, and everything can be lost quickly. Trump continues to dismantle everything built by his predecessors. This isn't just about a trade war — it's about the global order in which the U.S., the world's largest economy, was at the center. If the U.S. economy was strong, everything else was inevitably tied to it. There's China, Russia, India, the EU, and other major players. But in one way or another, everything revolved around the U.S. That era may soon come to an end.

The U.S. economy was once appealing to investors, but that is no longer the case. The desire to immigrate to America, once a common goal for many, is now changing. Where the economy used to grow steadily from year to year, it may now soon begin to contract. Inflation could rise to 4–5%, and how the Fed will handle it is unclear. In our view, the Fed is in a rather difficult but understandable position. After such an economic disaster, every American will ask: who is to blame? And the answer will be obvious. The Fed can only do what it can — while trying to avoid stepping on "Trump's turf." It risks losing on both fronts if it tries to support the weakening economy at the expense of tolerating high inflation. Meanwhile, Trump can say again that he was right — that rates should've been cut years ago or more aggressively and swiftly.

Thus, the U.S. dollar — which enjoyed dominance for 16 years — may now be sidelined for an extended period. On one hand, the U.S. economy remains strong enough that the dollar may not continue its current rate of decline. On the other hand, everyone in the market understands that things aren't likely to improve anytime soon. So, betting on the dollar's growth in the short term also seems unwise. On higher timeframes, a reversal of global trends has already begun or may be starting. Of course, with Trump's unpredictable nature, everything could change overnight. That's the core problem for traders — Trump is unpredictable, but his actions now dictate a great deal.

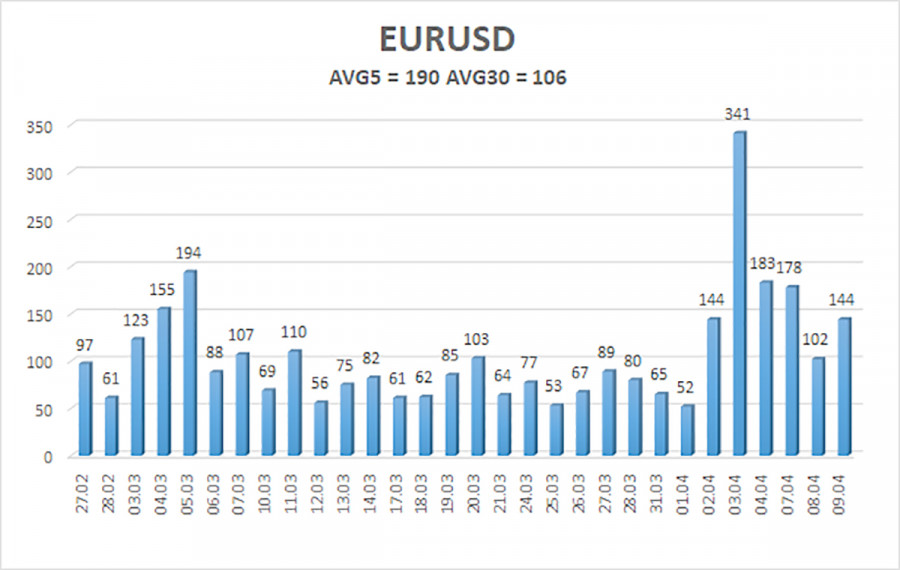

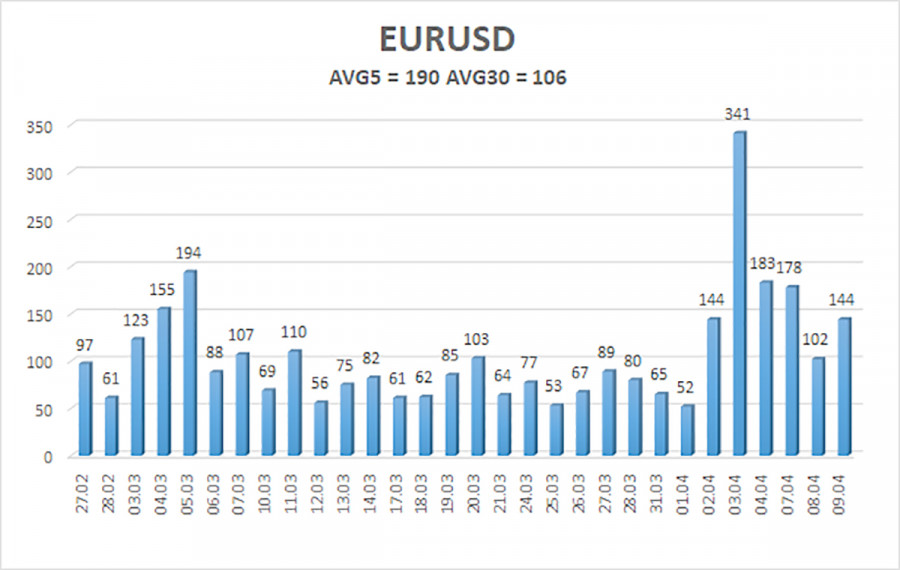

The average volatility of the EUR/USD pair over the last five trading days as of April 10 is 190 pips, which qualifies as "high." On Thursday, we expect the pair to move between 1.0845 and 1.1225. The long-term regression channel is pointing upward, indicating a short-term uptrend. The CCI indicator had entered the overbought zone, signaling a potential start of a correction. However, the trend remains upward for now.

Nearest Support Levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest Resistance Levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading Recommendations:

EUR/USD continues to follow an upward trend. For the past few months, we've consistently said that we expect the euro to fall in the medium term, and that hasn't changed. The dollar still has no reason to decline, aside from Donald Trump. But that reason alone continues to push the dollar into the abyss. This is an unprecedented and rare case in currency markets. Short positions remain attractive, with targets at 1.0315 and 1.0254, but it's extremely difficult to say when the current "Trump-driven" rally will end or how many more tariffs and sanctions the U.S. president may introduce.

If you're trading based purely on technicals, long positions can be considered if the price remains above the moving average, with targets at 1.1108 and 1.1230.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.