Analysis of Trades and Trading Tips for the British Pound

The first test of the 1.2912 price level occurred when the MACD indicator dropped significantly below the zero mark, limiting the pair's downward potential. For this reason, I did not sell the pound. Shortly afterward, the second test of 1.2912 coincided with MACD being in the oversold zone, allowing scenario #2 for buying to play out, leading to a 20-pip rise in the pound.

A slight increase in the U.S. unemployment rate and a slower rise in new jobs negatively impacted dollar purchases but did not lead to active sell-offs. Investors have taken a wait-and-see approach, assessing how sustainable the slowdown in U.S. economic growth is and how quickly the Federal Reserve will respond to these changes. On the one hand, deteriorating macroeconomic indicators could push the Fed toward a more cautious monetary policy and further rate cuts, weakening the dollar. On the other hand, the resilience of the U.S. economy compared to other developed countries continues to support demand for the dollar.

In the short term, the dollar's movements will depend on the upcoming U.S. inflation and employment data, along with statements from Fed officials. Since there are no economic releases from the UK today, the currency pair is likely to remain within a sideways trading channel for most of the session.

For intraday strategy, I will focus more on implementing Scenarios #1 and #2.

Buy Signal

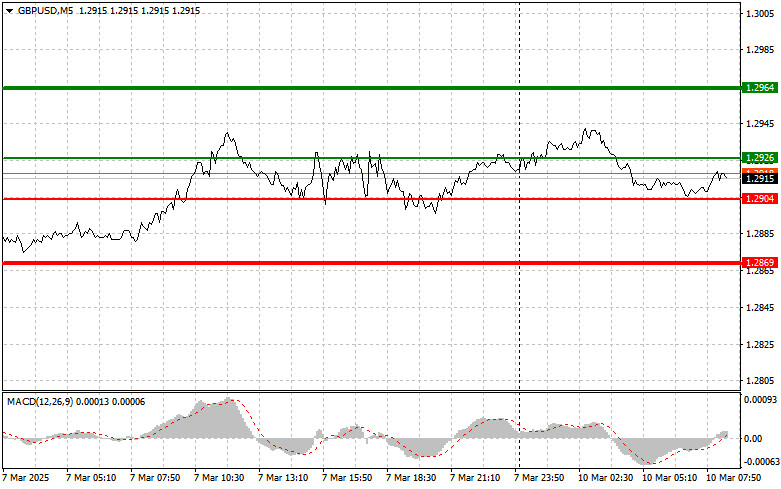

Scenario #1: Today, I plan to buy the pound at an entry point of around 1.2926 (green line on the chart), aiming for an increase toward 1.2964 (thicker green line on the chart). At 1.2964, I intend to exit buy positions and open sell positions in the opposite direction, expecting a 30-35 pip move from this level. The pound's growth can be expected to continue the upward movement. Important! Before buying, ensure that the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.2904 level when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger an upward market reversal. A rise toward the opposite levels of 1.2926 and 1.2964 can be expected.

Sell Signal

Scenario #1: Today, I plan to sell the pound after it breaks below 1.2904 (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be 1.2869, where I plan to exit sell positions and immediately open buy positions in the opposite direction, expecting a 20-25 pip move from this level. Selling the pound is preferable from as high as possible. Important! Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.2926 level when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels of 1.2904 and 1.2869 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.