GBP/USD

Analysis:Since August last year, the GBP/USD chart has been defined by a downward wave. Starting January 13, a counter-correction has formed against the primary trend, which remains incomplete. The price is consolidating along the breached intermediate resistance level from last week, which now acts as new support.

Forecast:In the coming days, GBP/USD is expected to move sideways. A decline toward the calculated support zone is possible. The latter half of the week could see increased volatility, with a potential return to the upward trend and a move toward the resistance zone.

Potential Reversal Zones:

- Resistance: 1.2690/1.2740

- Support: 1.2450/1.2400

Recommendations:

- Sell: Consider short-term trades during individual sessions with reduced volume sizes, as potential is limited by support.

- Buy: Suitable after confirmed reversal signals near the support zone using your trading systems.

AUD/USD

Analysis:The daily price movement of the AUD/USD pair is shaped by an ongoing bearish wave from September 30, 2022. Over the past four weeks, the price has formed a corrective flat near a strong potential reversal level. The structure remains incomplete.

Forecast:Expect the upward price trend to continue in the coming days. In the latter half of the week, a reversal and resumption of the downtrend are more likely. A brief breach of the upper resistance boundary is possible during a directional change.

Potential Reversal Zones:

- Resistance: 0.6380/0.6430

- Support: 0.6250/0.6200

Recommendations:

- Buy: Short-term trades with small volume sizes are possible within intraday sessions.

- Sell: Suitable after confirmed reversal signals near the resistance zone.

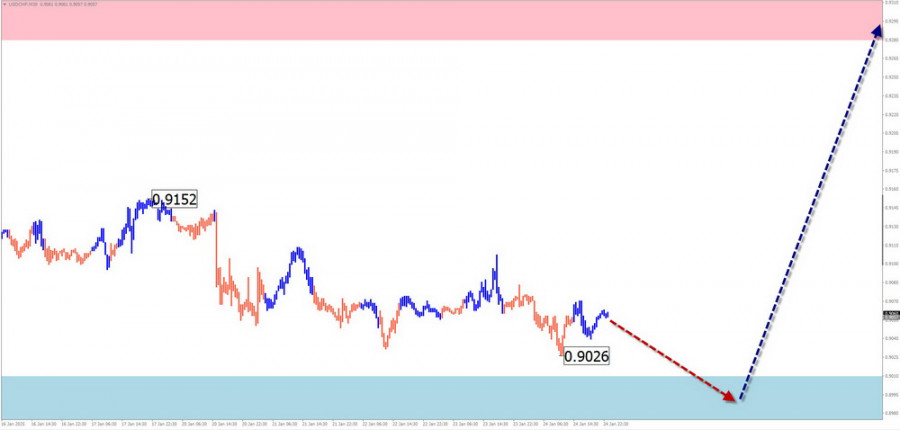

USD/CHF

Analysis:The USD/CHF pair has been in a bullish wave since last summer. Within the wave's final segment (C), an intermediate pullback in the form of a shifting flat has been developing since the start of the year. In recent weeks, prices have retreated toward support.

Forecast:This week, USD/CHF is likely to complete its pullback and resume its uptrend. Price movements will be contained within the nearest counter-directional zones. A reversal and upward movement are more likely in the latter half of the week.

Potential Reversal Zones:

- Resistance: 0.9280/0.9330

- Support: 0.9010/0.8960

Recommendations:

- Sell: High risk with limited potential.

- Buy: Suitable after confirmed reversal signals near the support zone using your trading systems.

EUR/JPY

Analysis:The dominant trend for EUR/JPY since December 2022 has been bullish. Over the past two weeks, the pair has formed a horizontal counter-correction. This wave structure appears close to completion.

Forecast:Expect a predominantly sideways price movement in the coming days. A downward vector could take prices toward the support zone. Increased volatility, a reversal, and a resumption of the uptrend are likely closer to the weekend.

Potential Reversal Zones:

- Resistance: 165.10/165.60

- Support: 163.00/162.50

Recommendations:

- Buy: Consider buying after confirmed reversal signals near the support zone.

- Sell: Possible with reduced volume sizes, but potential is limited by support.

USD Index (DXY)

Brief Analysis:The downward wave for the USD Index, which began in mid-December 2022, has exceeded the corrective level of the previous trend segment and is evolving into a full-fledged correction of the entire wave. The wave structure has formed a clear extended flat, with the calculated support near the upper edge of the preliminary target zone.

Weekly Forecast:This week, there is a high likelihood of the downtrend completing. After a potential rebound toward the resistance zone, the index may resume its decline toward the calculated support boundaries.

Potential Reversal Zones:

- Resistance: 107.50/107.70

- Support: 106.40/106.20

Recommendations:

- The period of dollar weakening is likely to continue through the end of the week. Trades aimed at reducing positions in major currency pairs will become relevant after reversal signals appear near the support zone.

Notes: In simplified wave analysis (SWA), all waves consist of three parts (A-B-C). The analysis focuses on the most recent incomplete wave across all timeframes. Expected movements are shown with dashed lines.

Attention: Wave algorithms do not account for the duration of price movements over time!