Analysis of Trades and Trading Tips for the British Pound

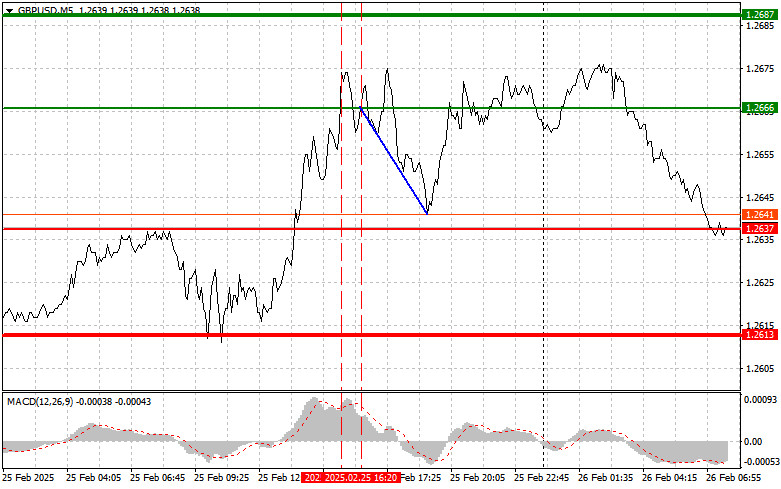

The test of the 1.2666 level occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upside potential. For this reason, I did not buy the pound. Shortly after, the second test of this level happened when the MACD was in the overbought zone, providing a reason to execute Scenario #2 for selling the pound. As a result, the pair declined by 20 pips.

Investors reacted by selling the U.S. dollar following the publication of consumer confidence data in the U.S., which saw a sharp decline. This fueled speculation about a potential monetary policy easing by the Federal Reserve. The weakening of the dollar, in turn, made the British pound more attractive to buyers looking to diversify their assets.

The future movement of the pound will be influenced by several factors, including the Fed's upcoming decisions, geopolitical conditions, and UK macroeconomic indicators, which are unfortunately absent today.

During the European session, there is no key economic data release scheduled—only a speech by Swati Dhingra, a member of the Bank of England's Monetary Policy Committee. Her remarks may indirectly affect the direction of the pound. Dhingra emphasizes the importance of taking a cautious approach to monetary easing, noting the delayed effects of interest rate changes on the economy. She advocates for a thorough analysis of data to prevent excessive tightening, which could potentially harm economic growth.

According to Dhingra, current inflation is primarily driven by external factors, such as rising energy prices, and tight monetary policy is not always an effective tool to combat these trends. She suggests considering alternative measures, such as support for vulnerable groups and investment in green energy, which could reduce dependence on imported energy resources in the long run.

Regarding intraday strategy, I will primarily rely on Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound at 1.2651 (green line on the chart), targeting a rise to 1.2698 (thicker green line on the chart). At 1.2698, I plan to exit the market and sell the pound in the opposite direction, aiming for a 30-35 pip downward move. The pound's growth potential depends on hawkish statements. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I will also consider buying the pound if the 1.2630 level is tested twice in a row while the MACD indicator is in the oversold zone. This would limit the pair's downside potential and trigger a reversal to the upside, with a possible move toward 1.2651 and 1.2698.

Sell Signal

Scenario #1: I plan to sell the pound after breaking below 1.2630 (red line on the chart), which would likely result in a quick drop. The key target for sellers will be 1.2584, where I plan to exit the market and immediately buy in the opposite direction, expecting a 20-25 pip retracement. It is better to sell the pound at the highest possible level. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I will also consider selling the pound if the 1.2651 level is tested twice in a row while the MACD indicator is in the overbought zone. This would limit the pair's upside potential and trigger a downward reversal, with possible targets at 1.2630 and 1.2584.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.