US Stock Markets Recover After Trump's Tariff Announcement

US stock index futures rose on Monday, recouping some of the losses incurred in the previous trading session. The recovery was driven by steel stocks, which came into focus after US President Donald Trump announced additional tariffs on steel and aluminum imports.

A New Wave of Trade Confrontation

On Sunday, Trump announced his intention to impose 25 percent tariffs on all steel and aluminum imported into the US, in addition to the tariffs already in place on these metals. This decision was the latest step in the president's strategy to protect American industry and strengthen the country's trade position.

Metal giants soar

The market reacted immediately to the news, with U.S. Steel (X.N) shares rising 9.7% in premarket trading after Japan's chief cabinet secretary said Nippon Steel (5401.T) was considering a major adjustment to its plan to acquire the U.S. company.

Other steel companies also saw strong momentum. Cleveland-Cliffs (CLF.N) jumped more than 12%, Nucor (NUE.N) added about 10%, and aluminum producer Alcoa (AA.N) posted a 6.2% gain.

More retaliatory measures on the way

The president also said he would unveil additional retaliatory tariffs for all countries on Tuesday or Wednesday. They would be implemented almost immediately and would be in line with existing tariffs imposed by various countries.

Experts: the market is already adapting

A Jefferies research note notes that investors are becoming less receptive to Trump's harsh statements about tariffs.

"These measures will inevitably lead to short-term volatility, but their main purpose is to be a negotiating tool. Ultimately, the impact of new tariffs may not be as destructive as it seems at first glance," experts believe.

Thus, despite the risks associated with trade wars, the market is demonstrating confident attempts to adapt, and the metallurgical sector has already felt a tangible positive effect from the ongoing changes.

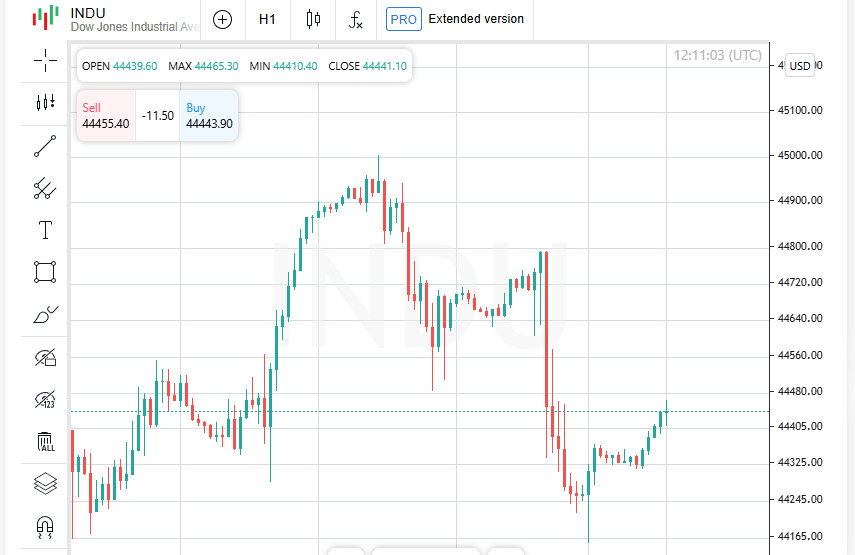

Indices are going up despite recent losses

In the early morning Eastern time, futures on US stock indices showed confident growth. Dow E-mini futures added 122 points (+0.27%), S&P 500 E-mini rose 21.5 points (+0.36%), and Nasdaq 100 E-mini showed the strongest growth, adding 116 points (+0.54%).

The market's rise was largely due to the recovery of shares of the largest technology companies. Thus, Microsoft (MSFT.O) and Meta Platforms (banned in Russia) strengthened their positions by about 0.6% each, which signals a renewed interest in growth stocks.

Awaiting reports from major corporations

Today, the market's attention is riveted on the upcoming financial report of McDonald's (MCD.N), which is an important component of the Dow Jones index.

In addition, such major players as Coca-Cola (KO.N), delivery service DoorDash (DASH.O), insurance company CVS Health (CVS.N) and networking giant Cisco (CSCO.O) will present their results during the week. Investors expect that their reports may influence the further dynamics of the market.

Markets recoup losses after Trump's statements

Despite the current recovery, stock indices are still under pressure. In the previous trading session, all three key indices - Dow Jones, S&P 500 and Nasdaq - lost about 1% each. This decline occurred against the backdrop of Donald Trump's announcement of plans to introduce retaliatory tariffs against a number of countries.

As the market tries to find a balance, traders are closely monitoring upcoming economic events that may affect the further movement of quotes.

Powell to testify before Congress: what to expect?

Another key event of the week will be the speech of US Federal Reserve Chairman Jerome Powell before Congress. His statements scheduled for Tuesday and Wednesday could provide further insight into the regulator's next steps regarding monetary policy.

In addition, early Wednesday morning, consumer price index data for January will be released. These figures could influence investors' expectations regarding inflation and possible changes in interest rates.

Amid all these events, the stock market remains tense, and the coming days could be decisive for its further direction.

Fed Remains Cautious Amid Uncertainty

The US labor market is showing stability, but the Federal Reserve is still unable to give a clear forecast of the impact of Donald Trump's economic initiatives on overall economic growth and inflation, Fed officials said on Friday, emphasizing that uncertainty remains a key factor for investors.

Inflation, despite the measures taken, is still at a high level, and the consequences of new trade restrictions could add additional instability. In these conditions, the Fed is refraining from making any harsh statements about the future course of monetary policy.

T-Mobile and Starlink: A New Stage in Telecommunications

Amid general market uncertainty, T-Mobile (TMUS.O) attracted the attention of investors with its new technology project. The company announced the start of large-scale testing of a satellite-cellular service developed jointly with SpaceX based on the Starlink network.

The news sparked a positive reaction in the market, with T-Mobile shares jumping 4.1% as investors appreciated the potential for the technology to revolutionize the communications market by connecting even the most remote corners of the planet.

European stocks rise cautiously

European markets have shown modest gains at the start of the week, despite potential fallout from U.S. tariffs, with energy and construction stocks leading the way.

The pan-European STOXX 600 index (.STOXX) was up 0.2% by 09:55 GMT, supported by rising oil prices and activity in the real estate sector.

Oil and gas companies gain ground

One of the biggest gainers on Monday was the oil and gas sector, with the index (.SXEP) rising 0.8%. BP was particularly strong, rising 6.4% after activist investor Elliott Investment Management increased its stake in the company. The same gains supported the UK's FTSE 100 (.FTSE), which rose 0.4%, approaching its all-time high.

Property and technology stocks show strong growth

Property, which is traditionally sensitive to interest rate changes, also showed positive dynamics, with the .SX86P index rising more than 1%.

The telecom sector also saw an increase, with the .SXKP index adding 0.8%, continuing the trend of strengthening positions of the major players in the sector.

Among tech companies, ASML Holding (ASML.AS) showed a rise of 1.3%, which contributed to the increase of the tech subindex .SX8P by 0.5%.

Markets remain under pressure, but for now find support

Despite the uncertainty associated with Trump's trade measures, European and US markets are showing moderate optimism so far. However, key events in the coming days, including the speech by Fed Chairman Jerome Powell and the publication of US inflation data, may significantly adjust market expectations.

Trade policy is back in the spotlight

Financial markets continue to closely monitor Donald Trump, who last Sunday announced his intention to introduce new 25% tariffs on steel and aluminum imports. In addition, the former US president said that in the coming days he will introduce additional retaliatory duties for all countries, which could provoke a new round of tensions in global trade.

Investors are assessing the potential consequences of these steps for the global economic balance, while business representatives are expressing concern about possible losses due to restrictions.

Metallurgy sector under pressure

The news about the tariffs immediately affected the stock markets. The Basic Resources Index (.SXPP), reflecting the dynamics of raw materials companies, fell by 0.3%.

The biggest blow fell on one of the world's largest steelmakers, ArcelorMittal, whose shares fell by 2.4%. This is not surprising, since European steel companies account for about 15% of all steel imports to the United States, and the introduction of new tariffs could significantly reduce their supplies.

Europe is ready to respond

The reaction to Trump's statements was immediate. German Chancellor Olaf Scholz said during the election debate that if the United States really imposes tariffs on European Union countries, a retaliatory step will follow "within an hour".

This tough stance confirms that the EU does not intend to leave trade restrictions without consequences, which, in turn, could lead to a further escalation of the economic standoff between Europe and the United States.

STOXX 600: Markets Ignore Trade War Threat

Despite potential risks, European investors are not panicking just yet. The pan-European STOXX 600 index closed higher on Friday, posting its seventh straight week of gains. This shows that markets continue to bet on strong quarterly results from major companies, while pushing the potential impact of trade tensions into the background.

Experts also note that Trump's tariff statements are no longer having a shocking effect on investors.

"I think his threats are gradually losing their force. The market is realizing that Trump's statements do not always mean that he will actually carry them out," comments Danny Hewson, head of financial research at AJ Bell.

What's next?

Amid these developments, markets remain tense. In the coming days, key players will be watching Trump's next steps and the reactions of world leaders. Also important for investors will be economic data and the upcoming speech by Fed Chairman Jerome Powell, who may shed light on the regulator's future policy.

Trade wars, inflation and central bank decisions are a combination of factors that could seriously affect global markets in the near future.

ECB advises to keep cool

European Central Bank Vice President Luis de Guindos urged EU countries not to panic over possible trade tariffs from the United States. He noted that initial statements regarding tariffs do not always translate into real decisions.

"We need to approach this issue with prudence and reasonableness, since many loud statements ultimately remain at the level of words," he emphasized.

This position is understandable: European markets have repeatedly encountered Donald Trump's economic rhetoric, and many analysts believe that his statements do not always translate into concrete actions.

ECB Allows Further Rate Cuts

The European Central Bank confirmed on Friday that the current level of interest rates is still in the range of 1.75% to 2.25%, which is considered "neutral" — that is, neither stimulating nor constraining economic growth.

However, with risks remaining, further rate cuts may be needed to support economic activity. The statement reinforces expectations that the regulator will ease monetary policy in the coming months.

Investors are closely monitoring the ECB's actions, as rate cuts could affect borrowing costs, the investment climate and overall stock market dynamics.

GTT Group shares crash after management change

Amid general uncertainty, some companies are facing internal turmoil. Shares of French engineering company GTT Group (GTT.PA) fell 3.9%, becoming the outsider of the STOXX 600.

The reason for the fall was the unexpected dismissal of CEO Jean-Baptiste Chouamet. The departure of a key executive has raised concerns among investors, who fear possible instability in the company's management and strategy.

Stock markets seek balance

While trade wars remain a serious threat to the global economy, European regulators are trying to maintain composure and flexibility. Central bank decisions and macroeconomic indicators will remain an important factor determining the behavior of markets in the coming weeks.

For now, investors are taking a wait-and-see attitude, assessing the risks and possible consequences of the latest statements by world leaders.