Analysis of Monday's Trades

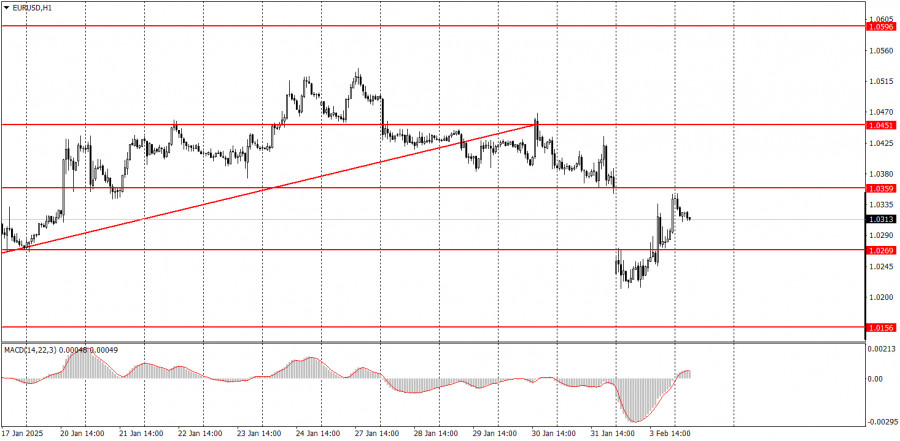

1H Chart of EUR/USD

The EUR/USD currency pair exhibited notable movements on Monday, driven solely by Donald Trump. Despite having several important macroeconomic reports scheduled for the day, they did not affect the market. On Sunday morning, it was announced that Trump signed an executive order imposing tariffs on imports from China, Mexico, and Canada. Initially, this news caused the dollar to surge at the market open. However, by the end of the day, the gap in pricing had closed, and the euro returned to its initial levels. Later in the evening, it was revealed that Trump had canceled the tariffs against Mexico and Canada, as both Mexico City and Ottawa agreed to cooperate with Washington on issues related to illegal immigration and drug trafficking. Consequently, the sanctions did not even last a day, yet they triggered significant turmoil across all markets. Overall, these movements only served to confuse the technical picture, which essentially remained unchanged.

5M Chart of EUR/USD

On the 5-minute timeframe, several trading signals were generated on Monday. In the morning, the price bounced twice from the 1.0221 level, which allowed novice traders to open long positions. The price attempted to break through the 1.0269-1.0277 area but failed on the first try, creating a false sell signal in that range. Subsequently, the price surged to 1.0334, where it bounced off, producing another sell signal. Finally, there was another bounce from the 1.0269-1.0277 area and a new test of the 1.0334 level. All signals, except one, were accurate.

Trading Strategy for Tuesday:

On the hourly timeframe, the EUR/USD pair is currently in a medium-term downtrend, and the previous local uptrend has been cancelled. As anticipated, a decline in the euro is expected, given that the fundamental and macroeconomic conditions continue to favor the US dollar. We expect a new wave of USD strength in the near future.

On Tuesday, we can expect further declines in the EUR/USD pair. However, the market may remain volatile today, especially with the uncertainty surrounding potential announcements from Trump.

On the 5-minute timeframe, key levels to watch are 1.0156, 1.0221, 1.0269-1.0277, 1.0334-1.0359, 1.0433-1.0451, 1.0526, 1.0596, 1.0678, 1.0726-1.0733, 1.0797-1.0804, and 1.0845-1.0851. There are no significant events scheduled in the Eurozone on Tuesday, while an important ADP employment report will be released in the US. However, it remains uncertain how much this report will impact a market that is primarily focused on developments related to Trump.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.