The EUR/USD currency pair continued its gradual decline on Friday. The price is falling slowly, and we believe that the euro should have experienced a much stronger downturn over the past week. Essentially, the overall fundamental outlook for the euro has not changed. For most of last year, we discussed how the euro was overvalued, and this downtrend has persisted for 16 years. Given these circumstances, what can we expect from the euro? Now at the beginning of 2025, despite Trump's arrival and his plans to impose tariffs on half of the world's countries, the dollar remains far more attractive than the euro or the pound. It's as simple as that.

The latest U.S. GDP report was disappointing, showing a +2.3% quarter-on-quarter increase. Similarly, the most recent Eurozone GDP report fell short for the eighth or ninth consecutive time, indicating 0% growth. Both reports were weaker than anticipated, but the disparity between them is substantial. The American economy continues to grow robustly despite elevated Federal Reserve interest rates. Conversely, the European economy, despite the European Central Bank's more aggressive rate cuts—which were already much lower than the Fed's—continues to struggle with poor performance. Now the question arises: into which currency do investors and traders want to move their capital? The one associated with steady growth, or the one that has been stagnating for over two years?

Last week, the ECB and Fed held meetings, but there was no possibility of these meetings reversing the trend in favor of the euro. The ECB further eased its monetary policy, and Christine Lagarde confirmed that rate cuts would continue in the near future. The Fed has paused its rate hikes, and this pause could extend until summer. By the end of the year, the Fed's rate might drop to 4%, while the ECB's rate could fall below 2%. Under these circumstances, which currency should appreciate?

Friday once more underscored a clear fact: the European economy is weak. Several significant reports were published in Germany. Even if the market had chosen to ignore them, these reports carry weight for the euro's long-term trajectory. Retail sales decreased by 1.6%, the unemployment rate increased, and inflation fell to 2.3%. On what grounds was the euro expected to rise on Friday? This macroeconomic backdrop persisted throughout the past week and has remained largely unchanged for some time. Last year, many experts were anxious about a potential recession in the U.S. economy, but that did not materialize. Since 2022, the market anticipated that the Fed would cut rates quickly and aggressively, but that also did not happen. In the context of a global downtrend, the market attempted to revalue the euro and push it as high as possible. Now, we are witnessing the results of that effort. Interestingly, the only factor that might benefit the euro at this point is Donald Trump, who has a strong aversion to an "expensive dollar."

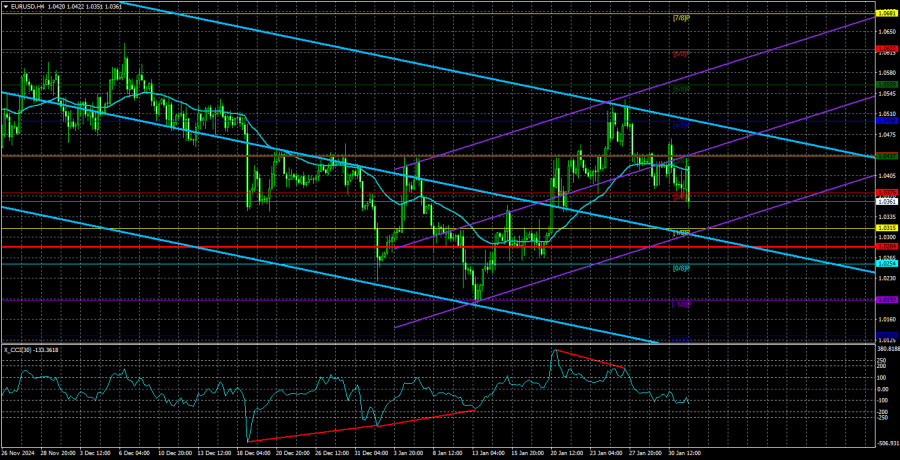

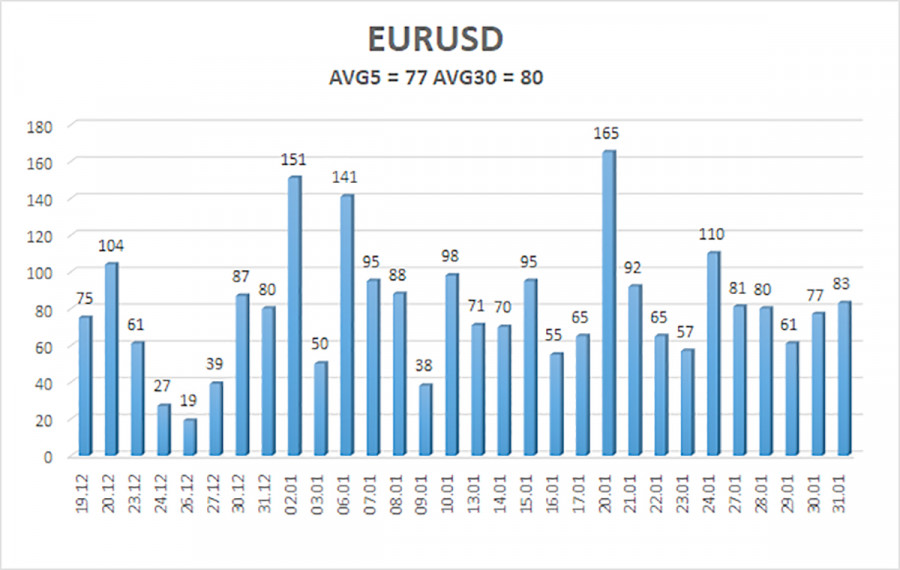

The average volatility of the EUR/USD currency pair over the last five trading days as of February 3 is 77 pips, considered "average." We expect the pair to move between the levels of 1.0284 and 1.0438 on Monday. The higher linear regression channel remains downward, and the global downtrend persists. The CCI indicator entered the overbought zone and formed a bearish divergence, after which a new decline began.

Nearest Support Levels:

S1 – 1.0315

S2 – 1.0254

S3 – 1.0193

Nearest Resistance Levels:

R1 – 1.0376

R2 – 1.0437

R3 – 1.0498

Trading Recommendations:

The EUR/USD pair is continuing its upward corrective movement, although the price remains consolidated below the moving average. For the past few months, we have consistently anticipated a decline in the euro in the medium term, and our view has not changed. The Fed has paused its monetary policy easing, while the ECB is, on the contrary, increasing it. As a result, the dollar has no substantial reason for a medium-term decline, aside from purely technical corrective factors.

Short positions are still valid, with targets set at 1.0315 and 1.0284. If you prefer trading based on "pure" technical analysis, you can consider long positions if the price moves above the moving average, with targets at 1.0498 and 1.0559. However, any upward movement at this point should be classified as a correction.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.