On Tuesday, the EUR/USD currency pair continued to trade in a calm manner. There was no significant fundamental or macroeconomic news, aside from a few minor events. The market seems to be in a waiting phase. Currently, Donald Trump is focused on resolving the conflict in Ukraine, with his team actively negotiating with Russia to end hostilities. However, the market is more concerned about Trump's decisions regarding tariffs on the European Union.

Over the past three years, financial markets have grown accustomed to the ongoing conflict in Ukraine. Wars are occurring worldwide—clashes in Gaza, the Middle East, and Africa no longer surprise anyone. Ukraine has simply become another hotspot on the global map. In contrast, Trump's potential sanctions against the EU are of much greater interest to currency values, stock markets, and the broader economy.

Trump has already announced a series of tariffs on imports from the European Union, but none have been officially implemented yet. As a result, Brussels is waiting to see what the US president decides. The EU intends to withstand American pressure, and it seems unlikely they will yield. The United States is one of the world's largest economies, and it's easy for Washington to issue ultimatums to countries like Colombia or Mexico. However, dealing with other heavyweight players is not as simple—manipulation, blackmail, and threats become much less effective. The European Union cannot afford to follow America's lead, as doing so would compromise its self-identity and global standing.

The EU is open to discussions with the US on all contentious issues but is also prepared to impose retaliatory tariffs within 24 hours of any US decision. This is not the only source of tension between the two powers. Trump believes that EU countries spend too little on defense and has threatened to withdraw from NATO. The EU, however, disagrees and is already considering forming its military alliance without the US. Additionally, Brussels does not fully understand why Washington is dictating terms to Ukraine while ignoring both Kyiv's and Europe's perspectives. Trump believes that the Ukraine conflict should be resolved between him and Vladimir Putin, but Europe does not share this view and refuses to accept a settlement that only satisfies Russia and the US.

The market is currently hesitant to make strong moves concerning the euro and the dollar due to several points of contention. For months, we have believed that the dollar would continue to strengthen; however, Trump's foreign policy may lead us to reconsider this stance.

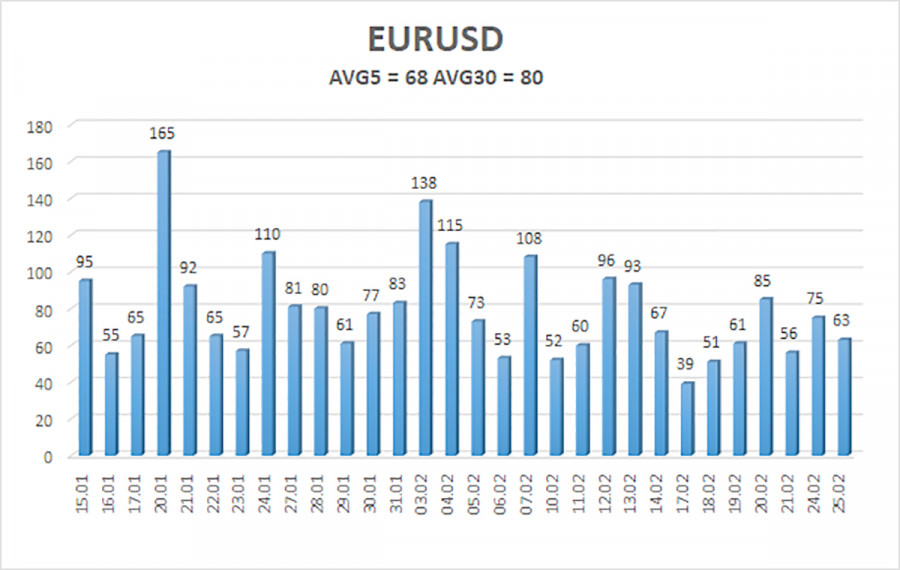

The average volatility of the EUR/USD pair over the past five trading days stands at 68 pips, which is classified as "moderate." We expect the pair to move between 1.0425 and 1.0560 on Wednesday. The long-term regression channel remains downward, indicating that the global downtrend is intact. The CCI indicator recently entered the oversold zone, triggering a new upward movement from the bottom.

Nearest Support Levels:

S1 – 1.0437

S2 – 1.0376

S3 – 1.0315

Nearest Resistance Levels:

R1 – 1.0498

R2 – 1.0559

R3 – 1.0620

Trading Recommendations:

The EUR/USD pair continues its upward correction. For months, we have reiterated our expectation of a medium-term decline for the euro, and nothing has changed in this regard. The dollar still lacks fundamental reasons for a medium-term decline—except for Donald Trump. Short positions remain more attractive, with initial targets at 1.0376 and 1.0315. However, the pair is in a flat phase on the daily timeframe, and technical correction may continue. If you trade purely on technicals, long positions can be considered if the price stays above the moving average, with targets at 1.0498 and 1.0559. However, any rise should still be viewed as a correction on the daily timeframe.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.